Collusive Oligopoly | A-Level Economics Model Paragraph (AQA, Edexcel, OCR)

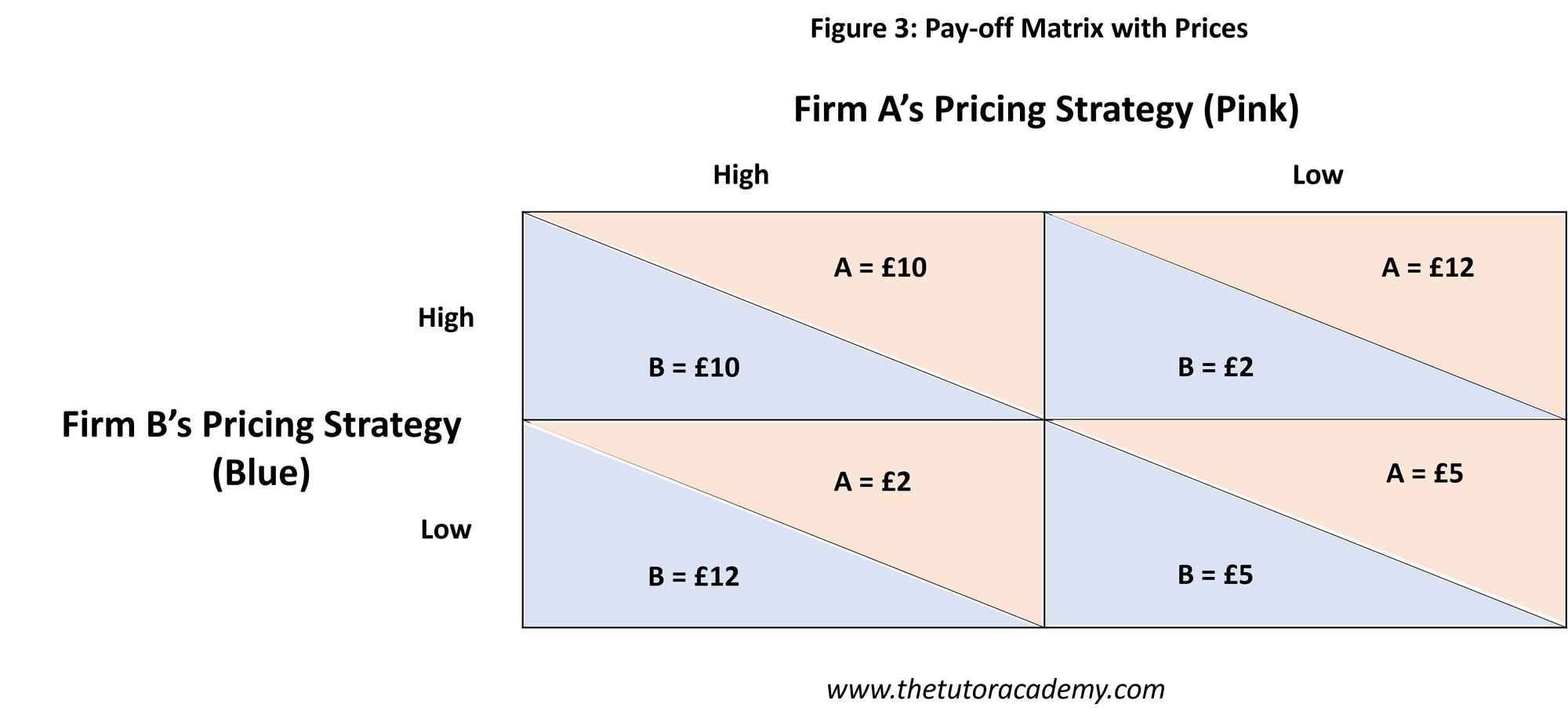

An oligopoly market has high barriers to entry, and a few firms dominate the market. If there are only two or three firms with a similar market share, they are more likely to be tempted to collude. The diagram below explains why firms would prefer to collude.

The diagram shows that Firm B will be better off choosing a low price if they know that Firm A is setting a high price. Undercutting Firm A means Firm B will have a payoff of £12 compared to only £10. Also, if Firm B knows that Firm A will be setting a low price, Firm B will be better off matching them with a low price to avoid being undercut. This will get them a payoff of £5 compared to £2. This logic leads to both firms setting a low price, unless they are able to communicate. Collusion is illegal but they may also communicate informally (tacit collusion), and both firms would recognise that if they both set a high price (no undercutting), they can both share higher profits, so this is a likely outcome in an oligopoly market.

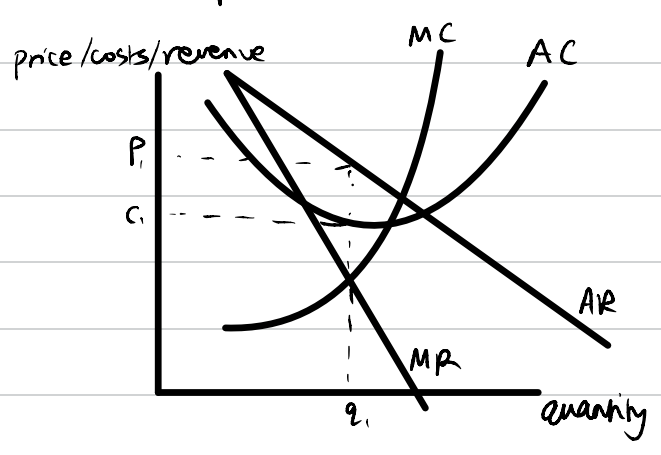

The two firms share monopoly power, and act as if they are a single monopoly.

Consumers would suffer as there would be allocative inefficiency as price is far higher than marginal cost. Firms would instead set prices high and limit quantity, at the point where MC = MR. The shaded rectangle shows their supernormal profits.

Further Support

These model paragraphs and chains of reasonings provide a foundation for writing A-Level Economics essays. For personalised feedback on your own essays or for extra help understanding content, we welcome your enquiries regarding A-Level Economics tutoring.