Explain why the housing market is not a perfectly competitive market

Extract B (lines 10 and 11) states ‘However, the housing market is not a perfectly competitive market.’ Explain why the housing market is not a perfectly competitive market. (June 2016)

Perfect competition is a market structure where there are many buyers and sellers, perfect information, no barriers to entry or exit, and homogenous products.

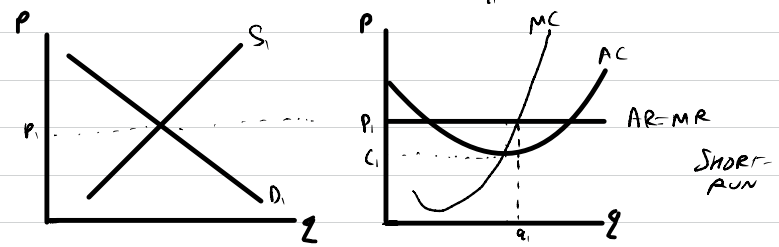

Firms in a perfectly competitive market aim to profit maximise. The diagram below shows the outcome in the short run.

Firms choose to profit maximise so they set a price and quantity based on the point where MC=MR. Also, firms are price takers so they have a perfectly elastic AR curve based on the market price. Firms in the housing market may not be perfectly competitive because demand would not be perfectly elastic. One reason for this may be that perfect competition is modelled with the assumption of infinite subsitutes which are identical, but this would not be the case for housing.

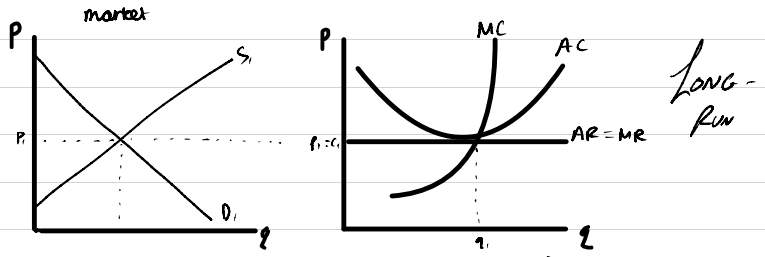

Secondly, even in the long run, the perfect competition model has differences to the housing market.

The diagram shows that in the long run, new firms enter the market because there are no barriers to entry and firms were attracted to enter due to the short-run supernormal profit. Firms only make normal profit in the long-run. Firsly, the housing market is likely to have high barriers to entry because of a lack of land or spare capacity and tight regulations preventing new firms from building or selling houses. Also it is likely that firms in the housing market may make supernormal profit, even in the long run.