Explain the likely effects of imposing indirect taxes on alcohol

Extract E (lines 1–2) states: ‘alcohol has traditionally been viewed as a demerit good, subject to high indirect taxes’. Explain the likely effects of imposing indirect taxes on alcohol. (June 2022)

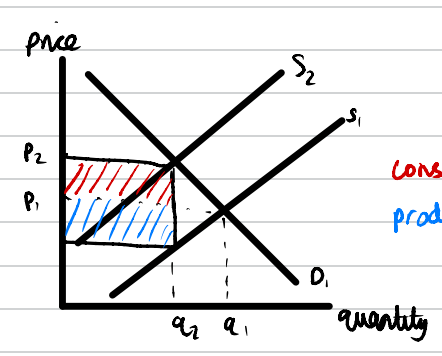

An indirect tax is an additional cost of production, imposed by the government on firms. This would cause the supply curve in the alcohol market to shift to the left. Alcohol is a demerit good, which is a good that has negative externalities in consumption.

As a result of the left shift in the supply curve, there is a decrease in the equlibrium quantity from q1 to q2 and an increase in the price of alcohol from p1 to p2. The vertical distance between the supply curve shows the amount of the tax per unit. Therefore, the entire rectangle shows the total tax revenue the government will collect from this intervention. The tax has a different burden on consumers compared to producers, as shown by the red and blue shaded areas. Finally, the white triangle shows the deadweight loss. This is the decrease in consumer and producer surplus as a result of the tax. Consumer surplus is the difference between the price consumers actually pay compared to the price they were willing to pay.