Explain how monetary policy can be used to control inflation

Extract F (line 7–8) states that ‘This is a move away from the more familiar role of interest rates, which has been to control inflation.’ Explain how monetary policy can be used to control inflation. (Specimen)

Inflation is an increase in average price level. A 2% rate of inflation is one of the four main macroeconomic objectives. Monetary policy is the use of interest rates to control aggregate demand and therefore the rate of inflation.

If inflation gets too high, the Bank of England could increase interest rates. Interest rates are the cost of borrowing or the reward for saving. Therefore, a higher interest rate would make it more attractive for people to save, and less attractive for consumers and businesses to borrow. This would lead to a fall in consumer spending and business spending. Aggregate demand is the total planned spending on goods and services produced in the UK economy. AD = C+I+G+(X-M), AD would decrease because of a decrease in C and I.

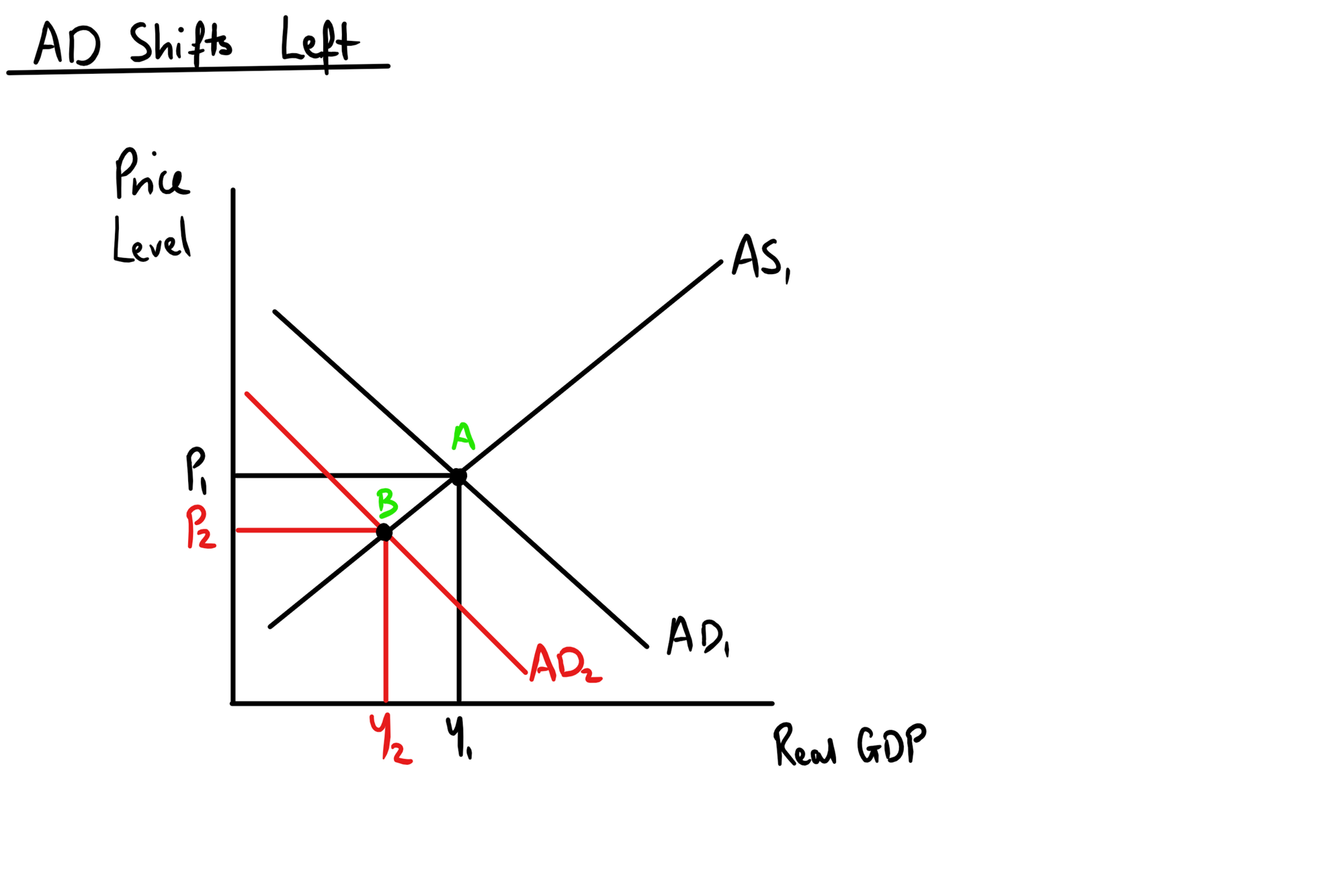

The diagram shows that there is a decrease in real gdp from y1 to y2 and also a decrease in price level from pl1 to pl2, back towards the target inflation rate of 2%.

Raising interest rates also has an effect on the exchange rate. Exchange rate is the price of currency in terms of another. If interest rates are higher, the reward for saving is higher. Thereofore, there will be an increase in demand for the pound from investors as they want the highest interest rates. Therefore, there will be hot money flows into the UK economy and the value of the pound will increase. Therefore, imports will become cheaper and exports will become more expensive. This will lead to a decrease in (X-M) which will also cause AD to shift to the left, and also cause the price level to fall further.