Evaluate the view that technological change tends to bring industries closer to the market structure of perfect competition

AQA A-Level Economics Model Essay

Below is a full model answer for the 25-mark essay question: "Evaluate the view that technological change tends to bring industries closer to the market structure of perfect competition." Use this example to see how to build a balanced argument with detailed analysis and evaluation.

AQA A-Level Economics Paper 1 June 2021

Evaluate the view that technological change tends to bring industries closer to the market structure of perfect competition.

Perfect competition is a market structure that is characterised by many buyers and sellers, identical products, perfect information, and no barriers to entry or exit. It is practically impossible to absolutely zero barriers to entry and exit, and absolutely perfect information. Perfect competition is a model mostly used as a benchmark for comparisons, but with technology, some industries are moving closer towards perfect competition while others are arguably moving further away.

On the one hand, technological change has brought industries closer towards the benchmark set by perfect compettion. Due to comparison sites such as uSwitch, information is more readily available. This means it is easy for consumers to find the best network when choosing a phone deal as all prices and terms are readily available to compare. If this is the case, it means that new customers will be able to choose the network with the lowest price. This means that firms will lose sales by setting a price above the market price.

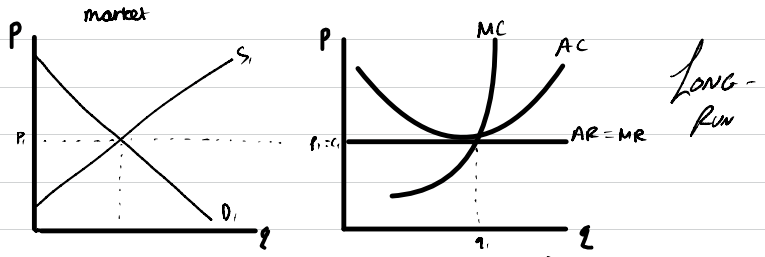

The diagram above shows the firm having a perfectly elastic demand curve, due to the fact that firms must accept the market price. We can see this when different firms are selling identical iphone 15 contracts for the same price.

However, perfect information and price takers are only two of the characteristics and the example of price-comparison sites being closer towards perfect competition. There are other issues that mean this is model is not achievable, even when there is perfect competition, such as in the way customers behave. Customers can show both loyalty to one provider despite increases in prices. This may be partly because of the likelihood of oligopolies to offer discounts and loyalty rewards, such as coffee vouchers, or similar to how Nando's offer free chillis (stamps) on their app for repeat customers. Secondly, behavioural economics teaches us that consumers are not actually seeking maximum utility at all times, and often follow heuristics. For example, to save time they many automatically renew their phone or insurance policies despite their being cheaper premiums elsewhere. This is known as customer inertia - the idea that customers are actually unreactive to price changes and substitute goods potentially being better.

On the other hand, technological advancements has brought some industries further away from the benchmark set by perfect competition. For example, technological advancements have allowed some individual firms to be able to signficicantly exploit their technical economies of scale. For example, companies like Apple have been able to reduce long-run average costs as they have increased their size and benefit from much more and much better technology than smaller firms as a result. This leads to Apple indirectly creating a barrier to entry in that new firms are discouraged from entering as it would be near impossible for them to compete with Apple due to Apple's significant cost advantages. This leads to Apple strengthening their market share and increasing their monopoly power.

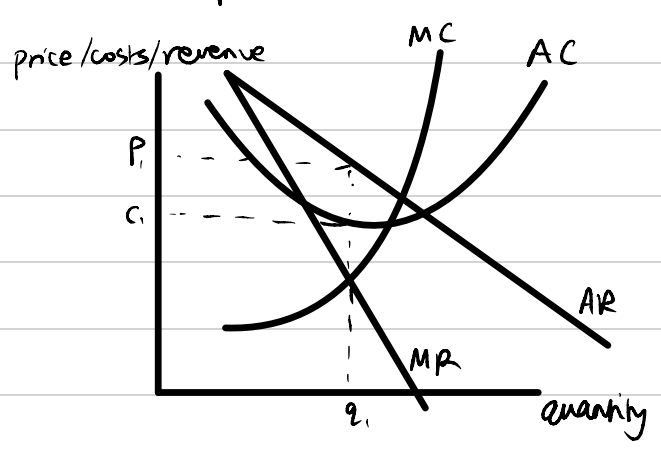

The diagram shows that Apple are able to exploit their price-setting power when they profit maximise at q1, which is where MC=MR. Customers are being over-charged and hence there is a lack of allocative efficiency in this outcome, as AR is not equal to MC, and P>MC. Consumer surplus is not maximised and the majority of welfare is in the form of producer surplus. This leads to supernormal profits which firms can either choose to pay shareholders with, or re-invest. If they are able to re-invest and improve their products, then this is going to benefit consumers increasingly over time. This is known as dynamic efficiency.

However, technological advancements can also have the opposite effect. Advancements such as AI are now acting as an external economy of scale in many industries. This means that all firms have equal access to knowledge and problem-solving. This can encourage new firms to enter a market and learn skills. This would lead to each firm having a lower amount of average revenue, and in the case of the monopoly above, this would move the market structure closer to monopolistic competition, which has lower prices and lower profits.

Overall, it is difficult to say that technological advancements always leads market structures closer to outcomes in perfect competition. This mainly depends on whether the advancements are able to benefit both existing and new firms in a market, or if it just increases the strength of the market leader. On average, I would say that technological advancements do make it easier for new firms, due to the direct link between technology and some of the key characteristics of perfectly competitive markets, namely perfect information and lower barriers to entry and exit.

Further Support

This model answer provides a template for your own essays. For personalised feedback on your writing, you can learn more about our A-Level Economics tutoring.