Evaluate the view that increasing taxation is the best way to reduce a budget deficit

Evaluate the view that increasing taxation is the best way to reduce a budget deficit. (June 2024)

- Plan

- Intro: budget deficit, conflict with main macroeconomic objectives

- Paragraph 1:

- Clear argument: increasing income or corporation taxes could decrease AD

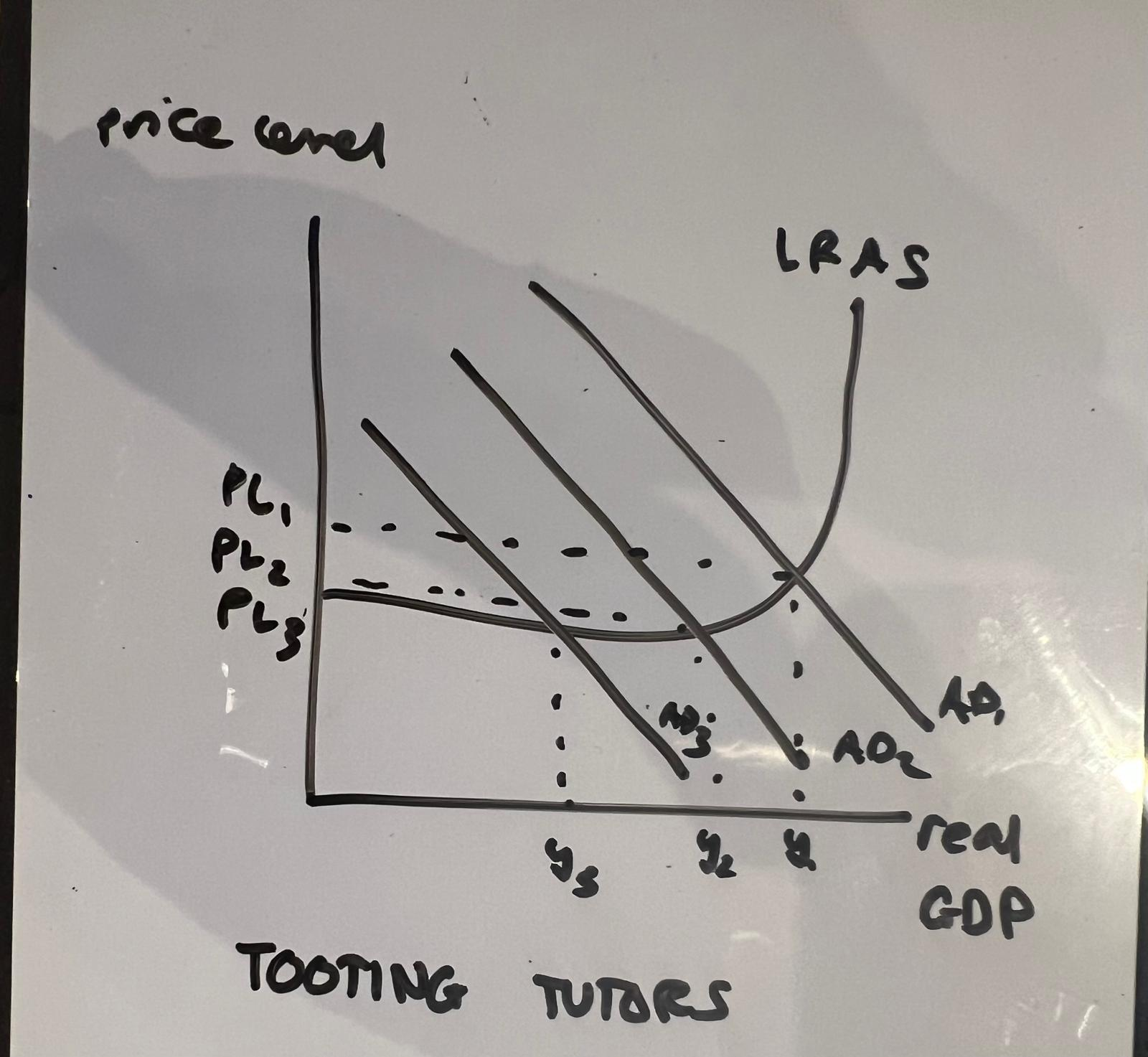

- Diagram: negative multiplier effect

- Evaluation: reduces budget deficit immediately but likely to cause future impact on tax revenue

- Paragraph 2:

- Clear argument: increasing taxes could also decrease LRAS

- Diagram: left shift in LRAS

- Evaluation: could we reduce unemployment benefits or increase tariffs?

- Judgement: impact on macroeconomic performance depends on the exact type of tax/spending

A budget deficit is when government spending is greater than tax revenue. The government can reduce the budget deficit by increasing some types of taxation or by reducing areas of government spending. As well as successfully reducing the budget deficit, the best policy should not have many conflicts with the four main macroeconomic objectives. The two options are to reduce government spending or to increase taxation.

One impact of raising taxation, such as income tax rates, is that it causes a left shift in aggregate demand. Income taxes are progressive in the UK, and they are a direct tax as a proportion of income that workers earn. Aggregate demand is the total planned spending on goods and services produced in the UK economy. AD = C+I+G+(X-M). If income taxes increase, then consumers have lower disposable incomes and lower consumer confidence, therefore consumption falls. This causes a left shift in aggregate demand. As businesses anticipate a fall in aggregate demand, business spending on capital goods would be likely fall as this would not be necessary, plus there would be fall in business confidence. This is known as the accelerator effect. This decrease in investment will lead to a further fall in aggregate demand, which is a negative multiplier effect, as shown below.

If this happens, there would be decrease in price level from PL1 to PL3, and a decrease in real GDP from y1 to y3. The decrease in price level could represent disinflation, or deflation, depending on the state of the economy. Deflation can be damaging as it could people to delay spending in anticipation of lower prices in the future, and also lead to further decreases in aggregate demand. A decrease in real GDP from y1 to y3 means that there is a decrease in the total value of goods and services produced in the UK economy. This would also lead to an increase in unemployment because there is less derived demand for goods and services, so firms will layoff workers.

However, despite the negative impacts of increasing taxes, they may be necessary as national debt is approaching 100% of the UK's GDP, which is alarmingly high. High levels of national debt is bad for two reasons. Firstly, every year, a large proportion of the budget deficit is used on interest repayments. The opportunity cost of this would have been additional spending on education or healthcare. Secondly, future generations would have to have extreme measures of austerity (spending cuts or tax increases), so it is arguably necessary to slowly implement budget surpluses to start reducing the national debt total.

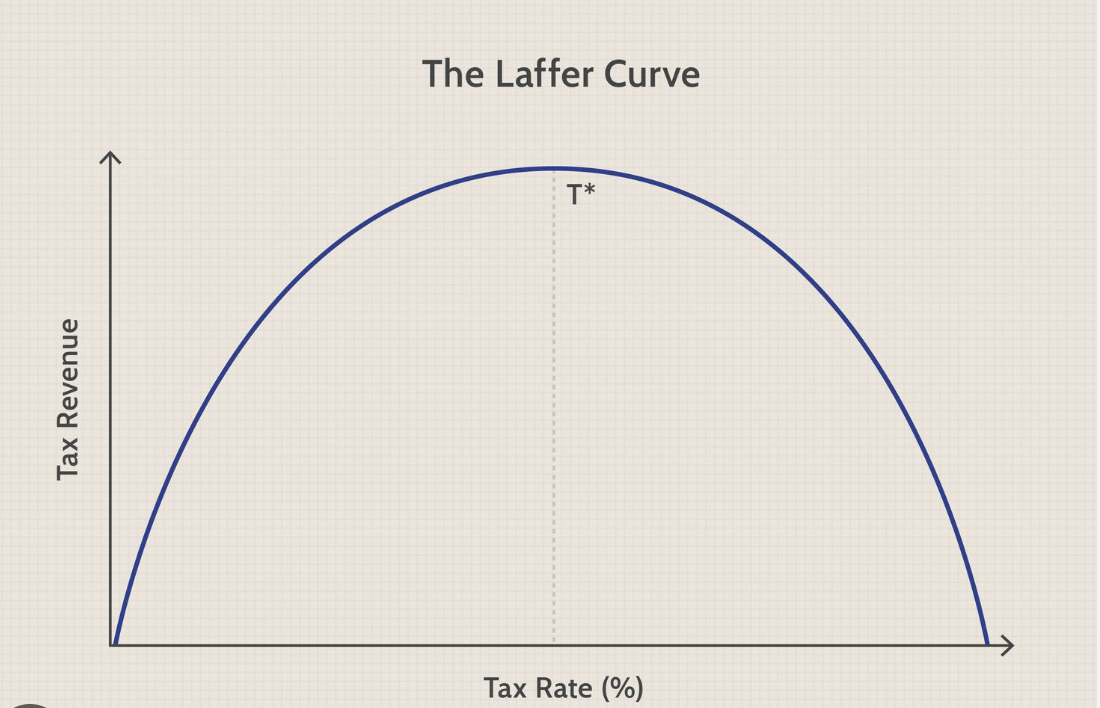

The second implication of increasing taxation, such as income taxes, is damage to the supply side of the UK economy. An increase in income tax leads to a reduction in incentives for skilled workers, hence they may choose to work less hours, or move to another country which is more rewarding to work in. The Laffer Curve illustrates the impact of setting tax rates too high.

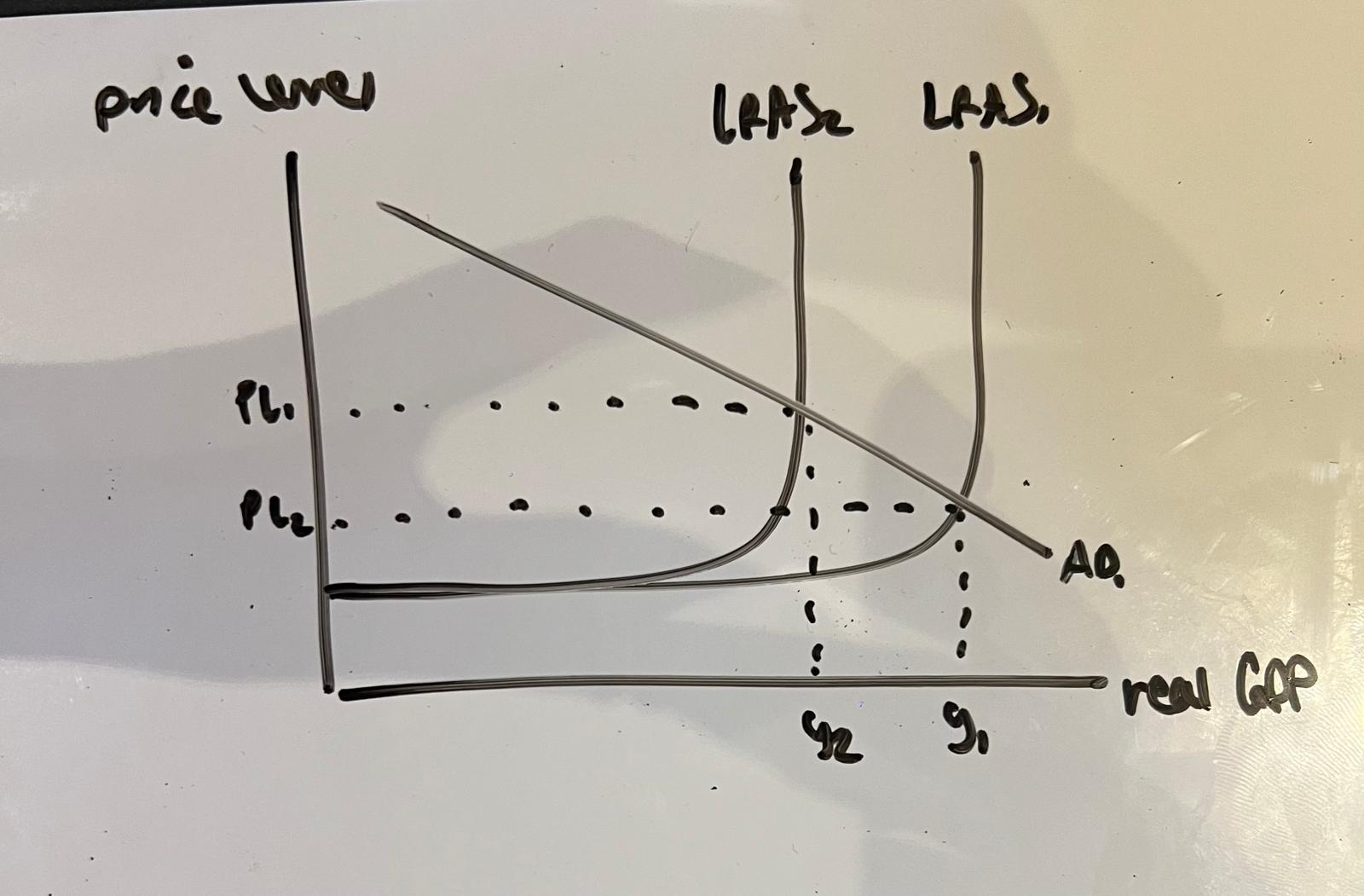

It shows that, after T*, increasing tax rates further actually reduces the total tax revenue collected because of a reduction in skilled workers on high incomes. If the UK's most skilled workers like top surgeons, or footballers like Cristiano Ronaldo leave the UK, to work in other areas such as the UAE, then this will harm the UK overall. The average skill level of workers remaining in the UK is likely to be lower, so the productive potential of the UK also falls, as we can produce less goods and services at maximum capacity. The effect of this is shown by a left shift in LRAS, which leads to a decrease in real GDP of y1 to y2 and a decrease in price level from pl1 to pl2, as shown by the diagram below.

This causes cost push inflation which is bad as consumers will suffer as they will have lower disposable incomes and suffer from a decline in living standards. It is also extremely costly for the government to find ways to increase LRAS back to its original position.

However, there are other ways to reduce a budget deficit that do not have a negative effect on the productive potential of the economy. For example, the government could reduce unemployment benefits, which would actually lead to an increase in the incentive for people to work, as the opportunity cost of unemployment is now greater. However, like with other spending cuts such as NHS cuts, this would cause an increase in inequality as this choice of policy would harm low income people more. This could lead to negative externalities such as crime increasing, causing other issues which the government may have to spend money to solve or control.

Overall, it is clear that a budget deficit can only be reduces through collecting more tax revenue or reducing government spending. However, it is really important to consider the impact that these spending cuts or tax hikes have on both immediate and long-term macroeconomic performance. In my opinion, anything that causes LRAS to shift left would be an ineffective approach to reducing the budget deficit, as it has many conflicts with the other objectives such as higher inflation and less long-term economic growth. So, the best way to reduce a budget deficit is to cut spending on projects that have the least benefit to society, or to consider reducing welfare benefits with the aim of a longer-term gain to the economy, with more people working and consuming.

- Plan 2

- Intro: budget deficit, conflict with main macroeconomic objectives

- Paragraph 1:

- Clear argument: increasing income or corporation taxes could decrease AD and decrease LRAS

- Diagram: left shift in AD and left shift in LRAS

- Evaluation: reduces budget deficit immediately but likely to cause future impact on tax revenue

- Paragraph 2:

- Clear argument: decreasing spending could also decrease AD but it depends on the exact type e.g. reducing welfare payments could increase LRAS

- Diagram: right shift in LRAS

- Evaluation: increase in inequality

- Judgement: impact on macroeconomic performance depends on the exact type of tax/spending