Edexcel A-Level Economics Notes | 4.1

What is globalisation?

The process of economies around the world integrating closer to being one single economy.

What are the main characteristics of globalisation?

- increase in trade (free trade)

- specialisation

What are the factors contributing to globalisation in the last 50 years?

- technology/ communication

- infrastructure/transport

Impacts of globalisation on high-income countries

- economic growth

- structural unemployment

- over-dependence and trade imbalances

Impacts of globalisation of low-income countries

- economic growth

- economic development

- workers are exploited

- environmental damage

What is absolute advantage?

When a country can produce a good or service at a lower cost than another country.

What is comparative advantage?

When a country can produce a good or service at a lower opportunity cost than another country.

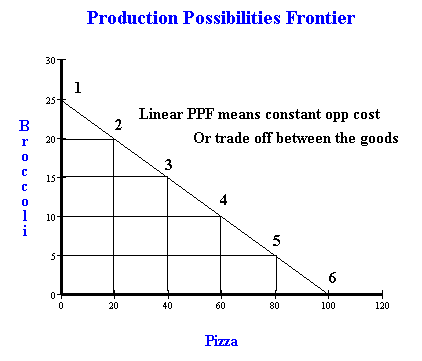

How to calculate opportunity cost?

- The opportunity cost of producing 100 pizzas is to give up on 25 units of broccoli.

- Therefore, the opportunity cost of producing 1 pizza is to give up on 0.25 units of broccoli.

- The opportunity cost of producing 25 units of broccoli is to give up on 100 pizzas.

- Therefore, the opportunity cost of producing 1 unit of broccoli is to give up on 25 units of pizza.

What does comparative advantage theory show?

- if countries specialise, we would see an increase in total world output

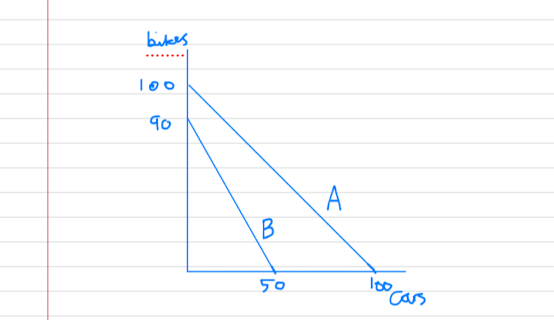

- if countries produced bikes and cars for themselves, we would see country A produce roughly 50 cars and 5o bikes and country B would produce roughly 25 cars and 45 bikes so total world output would be 170

- in this example, country A has an absolute advantage in both goods but country A has a comparative advantage in cars whilst country B has a comparative advantage in bikes.

- so, if country A specialised in cars and country B specialised in bikes, there would be a total output of 190 goods (100 cars from country A and 90 bikes from country B).

- this means real gdp would increase, which means there is economic growth.

- economic growth is beneficial as it means jobs are created due to the derived demand from goods and services.

- incomes also increase so living standards can increase.

- government can also generate more tax revenue.

What does comparative advantage theory assume?

- PPFs can shift in or out due to economic growth which means there is even greater incentive to specialise.

- There can be economies of scale or diseconomies of scale when countries specialise but the model assumes constant returns to scale.

- The model completely ignores transportation costs and environmental damage.

- In reality, countries can impose protectionist measures to protect themselves from being exploited.

What are the disadvantages of specialisation and trade?

- structural unemployment

- countries are more dependent on others, which leaves them more vulnerable to economic shocks e.g. due to natural disasters, conflicts, or protectionism.

In progress...

4.1.1 Globalisation

- Globalisation is the growing integration of the world’s economies into a single, international market.

- Globalisation involves free trade of goods and services, the free movement of capital and labour and the free interchange of technology and intellectual capital.

- Causes of globalisation: better technology, better transport, better IT and communication, containerisation, free trade, more MNCs.

- Globalisation can lead to lower prices due to competition, greater employment, economies of scale, free movement of labour and capital, technological transfers and greater innovation.

- On the other hand, globalisation may cause greater inequality, structural unemployment, environmental damage, trade imbalances (e.g. US with China), and losses of identity/ cultural diversity.

4.1.2 Specialisation and Trade

- Specialisation is when each person/ country completes a specific task in a large production process.

- Absolute advantage: when a country can produce a good/ service at a lower cost

- Comparative advantage: when a country can produce a good/ service at a lower opportunity cost.

- Comparative advantage theory states that, if each country specialise in their comparative advantage, total world output will always be greater.

- Assumptions: each country’s factors of production are fixed and immobile, there are constant returns to scale whilst demand, inflation and transport costs are considered stable.

4.1.3 Pattern of Trade

- Factors affecting trade: comparative advantage theory, emerging economies, trading blocs and bilateral trading agreements, exchange rates.

4.1.4 Terms of Trade

- Terms of trade = (average price level of exports/average price level of imports) x100%. We use a weighted basket of each.

- Terms of trade tells us how many exports need to be sold to buy a given level of imports.

- An increase in terms of trade is caused by a rise in export prices or a fall in import prices. Factors: exchange rates, relative inflation rates, changes in demand and supply.

- Impact of higher terms of trades: higher imports, lower exports.

- Evaluation: Marshall-Lerner condition.

- Marshall-Lerner condition: if the sum of PED for exports and PED for imports is less than one (both inelastic), an increase in export prices will actually cause an increase in the value of exports and a decrease in the value of imports - and vice-versa.

4.1.5 Trading Blocs and the WTO

- Types of trading blocs: free-trade areas, custom unions, common markets, monetary unions.

- Free-trade area: members face no protectionism against each other.

- Custom union: members face no protectionism against each other and place a common tariff on non-members.

- Common market: they remove trade barriers and also allow for the free movement of factors of production (capital/ labour).

- Monetary union: share the same currency and the same monetary policy

- Regional trade agreements 😄: 😦:

- Role of the WTO:

- Conflicts between regional trade agreements and the WTO:

4.1.6 Restrictions on Free Trade

- Reasons for protectionism: to reduce a balance of payments deficit on the current account (reduce imports), to increase domestic spending and create more jobs domestically.

- Tariffs: a tax on imports

- Quotas: a limit on the quantity of imports

- Subsidies to domestic producers: a payment made to reduce cost of production and shift supply to the right.

- Non-tariff barriers:

- Impact of protectionism: lower imports, retaliation (lower exports), higher costs of production, higher prices, tax revenue (tariffs).

4.1.7 Balance of Payments

- The balance of payments is made up of:

- the current account

- the capital and financial accounts

- Current account:

- trade in goods e.g. cars

- trade in services e.g. holidays/ university degrees

- income: returns from foreign investments

- transfers: gifts/ earnings from work

- Causes of a UK current account deficit:

- when the value of imports > value of exports

- strong pound (high interest rates)

- poor competitiveness of UK goods and services

- lack of good supply side policies

- high costs/ high prices/ low quality

- lack of good supply side policies

- Causes of a current account surplus:

- when the value of exports > value of imports

- Measures to reduce a current account deficit:

4.1.8 Exchange Rates

- Exchange rate: the price of one currency in terms of another.

- Floating exchange rate: the value of a currency is determined only by the demand and supply.

- Factors influencing floating exchange rate: demand and supply of the currency (exports, imports, interest rates).

- Pros: no need for currency reserves (no waste of resources/ money), we can control monetary policy (no conflicts), automatic correction of balance of payments, reduced risk of government failure.

- If there is a current account deficit (high imports and low exports), that means there would be a high supply of the pound (because we need to sell the pound to buy the foreign currency to buy the foreign goods). Therefore, if supply of the pound shifts to the right, the value of the pound would decrease, so this would make exports cheaper and imports more expensive - so the balance of payments can correct itself.

- Cons: self correction can be unlikely (e.g. why was there a deficit in the first place?).

- Fixed exchange rate: the value of the currency is determined by the government/ central bank, who hold large reserves of domestic and foreign currencies.

- For example, they can sell pounds to cause depreciate, or buy pounds to cause appreciation.

- Managed exchange rate:

- Revaluation:

- Appreciation: when the value (price) of a currency increases.

- Devaluation:

- Depreciation: when the value (price) of a currency decreases.

- Impact of exchange rate changes: if the pound appreciates, exports become more expensive and imports become cheaper - and vice versa.

- Marshall-Lerner condition: if the demand for exports and imports are price inelastic (PEDx + PEDm <1) then a currency depreciation will initially worsen the balance of payments on the current account.

- J-curve effect: after a currency depreciation, the balance of payments on the current account will initially worsen and then improve over time.

- FDI:

4.1.9 International Competitiveness

- Measures of international competitiveness: relative unit labour costs, relative export prices.

- Factors influencing international competitiveness:

- International competitiveness: 😄: 😦: