Edexcel A-Level Economics Notes | 3.4

3.4.1 Efficiency

What is allocative efficiency?

Allocative efficiency can be achieved by producing at the quantity where AR = MC.

Price equals marginal cost, which is optimal for society.

It is the equivalent of supply = demand in a free market, where consumer surplus is maximised.

What is productive efficiency?

Productive efficiency can be achieved by producing at the quantity where AC = MC.

Average costs are minimised.

If a firm is productively efficient, they are using their factors of production to produce maximum output at minimum cost. They are minimising waste and contributing their maximum to the economy.

What is dynamic efficiency?

Dynamic efficiency can be achieved by a firm who makes supernormal profits in the long-run.

We can assume they are re-investing their supernormal profits over time, which leads to innovation and greater quality goods and services. This means that consumers will have greater surplus if, over time, they are able to enjoy higher quality at the same prices.

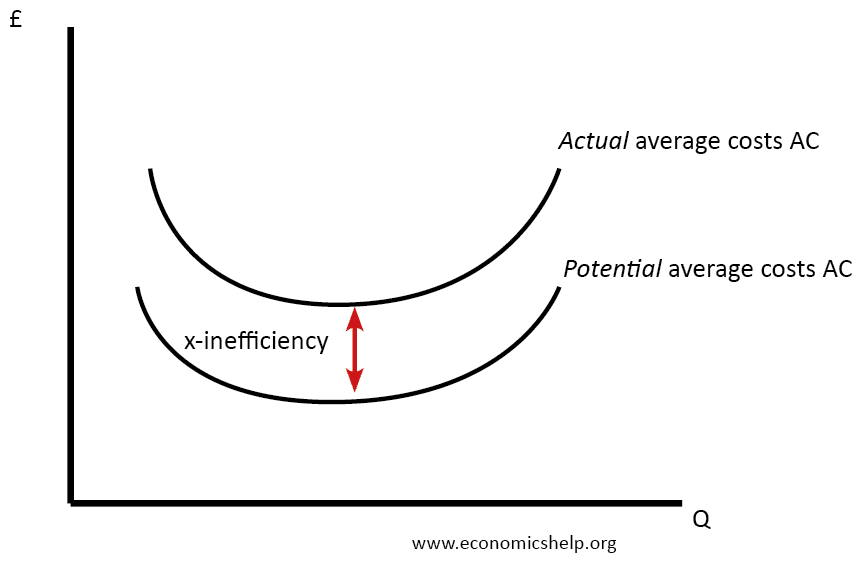

What is X-inefficiency?

X-inefficiency occurs when a firm has no incentives to control their average costs.

This can happen due to monopoly power or divorce of ownership from control. A monopoly knows they can make supernormal profit from charging higher prices instead of controlling costs.

3.4.2 Perfect Competition

What are the characteristics of a perfectly competitive market?

- Many buyers and sellers

- No barriers to entry or exit

- Firms are price takers

- Firms sell identical products

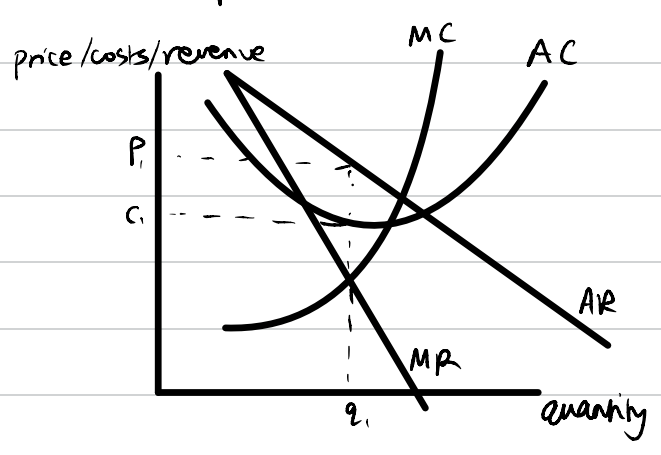

Perfect competition short-run diagram

AR (the demand curve) is perfectly elastic because firms are price takers and there are many sellers with identical subsitutes. Firms cannot raise or reduce price because they would lose demand, or other firms would copy them.

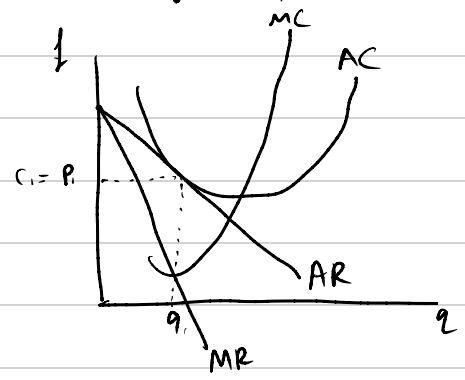

Perfect competition long-run diagram

What happens between the short-run and the long-run?

As firms are making supernormal profits in the short-run, oher firms notice that there are no barriers to entry so they join the market. This causes market supply to increase. Each firm has lower demand so AR shifts to the left and firms return to normal profits only.

3.4.3 Monopolistic Competition

What are the characteristics of a monopolistically competitive market?

- Low barriers to entry

- Slight product differentiation

- Firms are vulnerable to hit and run competition

Monopolistic competition short-run diagram

In the short-run, firms maximise profits at the point where MC=MR.

What happens between the short-run and the long-run?

As firms are making supernormal profits in the short-run, other firms notice that there are low barriers to entry so they join the market. This causes market supply to increase. Each firm has lower demand so AR shifts to the left and firms return to normal profits only.

Monopolistic competition long-run diagram

3.4.4 Oligopoly

What are the characteristics of an oligopoly?

An oligopoly is a market which is dominated by a few firms. Oligopolies can vary from being competitive to non-competitive or even collusive.

In a non-competitive oligopoly, one or two firms can have monopoly power (more than 25% market share) and they are also more likely to attempt to collude.

- high barriers to entry and exit

- firms are interdependent

- product differentiation

How to calculate an n-firm concentration ratio?

Add the market share of the top n firms.

Prisoner's dilemma and the two-firm two-outcome model

- Oligopolies can be collusive or non-collusive (competitive).

- Collusion is more likely if: only a few firms, similar costs,high entry barriers, ineffective competition policy, consumer inertia.

- Collusion leads to the outcomes in a monopoly.

- Cartel: a group of two or more firms agreeing to fix prices or limit output.

- Overt collusion: formal agreement made between firms. Tacit: informal.

- Competition is more likely if there are many firms and one has a large cost advantage.

- Game theory explains interdependence: the outcomes of your choice depend on what the other prisoner chooses.

- Prisoner's Dilemma: if both players think rationally by themselves, the outcome is worse than if they were able to communicate and decide together.

- Overt collusion is illegal.

- Price wars: firms undercut each other.

- Predatory pricing: set low prices to cause competitors to leave (illegal).

- Limit pricing: keep prices low enough that it is not tempting for new entrants.

- Price leadership: market leader changes prices and other firms copy.

- Non-price competition: customer service, loyalty discounts, branding.

- Pure monopoly: sole seller in a market.

- Monopoly power: more than 25% market share.

- Monopolies: price makers, product differentiation, high barriers to entry, imperfect information.

- Monopolies profit maximise (MC=MR) and set a high price and low quantity.

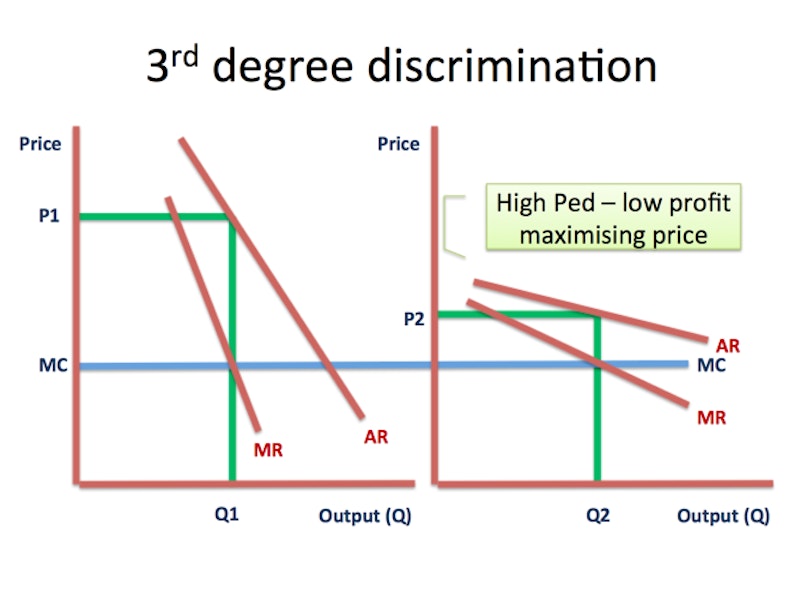

- Price discrimination is when firms charge different consumers different prices for the same good or service.

- Price discrimination can only happen if: firms can identify different consumer groups, the consumers show different elasticities, it is possible to prevent resale e.g. using ID.

- Third degree price discrimination: when two different groups have different AR curves due to different PEDs so they get charged different prices when MC=MR e.g. student vs normal cinema tickets, peak vs off peak train tickets.

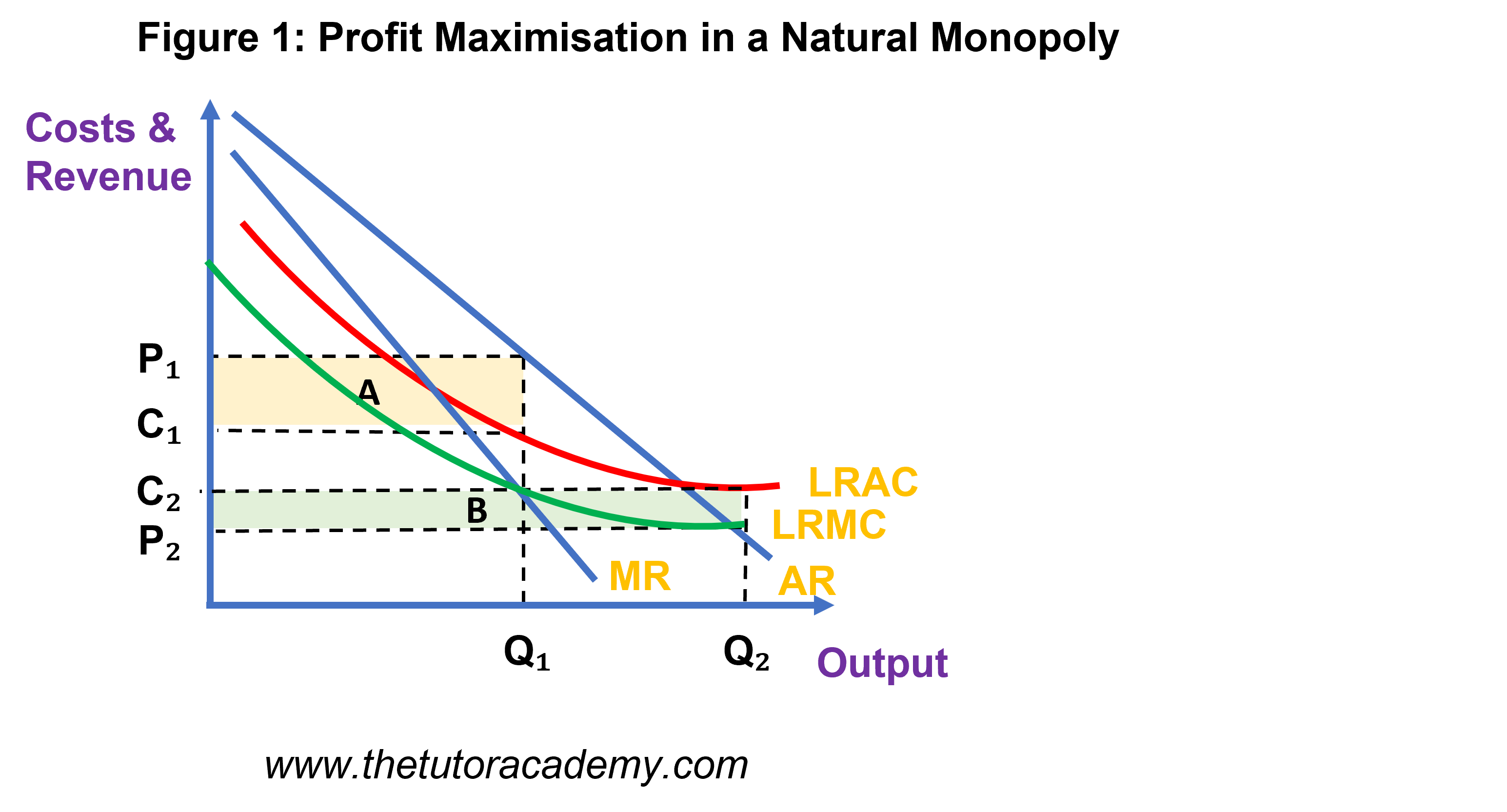

- Natural Monopoly: a market where economies of scale are so large that they cannot be fully exploited e.g. national rail, water, energy.

- In a natural monopoly, it is more efficient to have one firm in the market because there are very high fixed costs. So, new entrants would raise every firm's average costs.

- But, this gives the existing firm to profit maximise and set high prices.

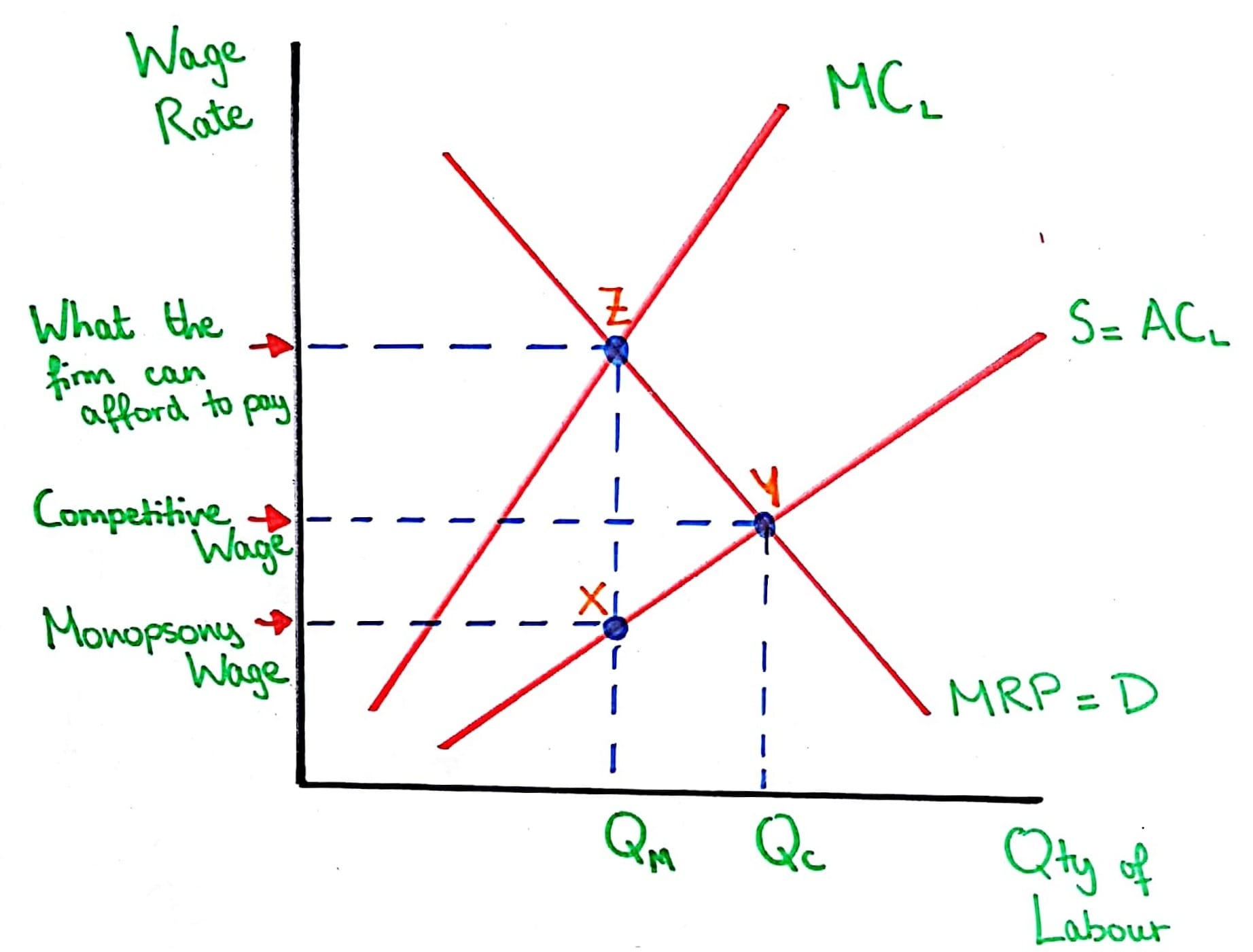

- Monopsony: a sole buyer e.g. sole employer in the labour market.

- Contestability: hit and run competition prevents firms from making supernormal profits in the long run.

What are the characteristics of a monopoly market?

- high barriers to entry

- firms are price setters

- product differentiation

Monopoly diagram

Outcome of a monopoly

A monopoly is a profit maximiser. They would produce at the quantity where MC=MR.

Is a monopoly dynamically efficient?

Monopolies are likely to achieve dynamically efficiency. This is because they make supernormal profits in the long-run, leading to innovation and greater quality goods and services. This means that consumers will have greater surplus if, over time, they are able to enjoy higher quality at similar prices.

Is a monopoly productively efficient?

Monopolies are not productively efficient because they don't produce at the lowest point of their AC curve. They don't have to do this because they can make supernormal profits due to their price-setting ability. This means they may waste resources or factors of production.

They may also be X-inefficient.

Is a monopoly allocatively efficient?

Monopolies are not allocatively efficient. This is because they choose to produce where MC=MR but allocative efficiency is achieved where AR=MC. Monopolies under-produce and over-charge consumers. If monopolies produced more goods and services at a lower price, consumer surplus would increase. This would benefit society as more people would benefit from Apple's products.

What is price discrimination?

Price discrimination is when a firm charges a different price to different consumers for the same good or service.

What are the conditions necessary for third degree price discrimination?

- the firm must be able to identify two groups of consumers

- both groups must show a different PED for their product

- the market should be able to prevent seepage

What is first degree price discrimination?

This is impossible but it is the hypothetical case where the firm knows the price that every single customer is willing to pay. There would be no consumer surplus left in the market.

What are the benefits of price discrimination?

- dynamic efficiency

- one group of consumers e.g. students benefit from greater consumer surplus

What are the disadvantage of price discrimination?

- the three conditions could be broken

- allocative inefficiency