Assess the view that very low interest rates are good for the UK economy

Use the extracts and your knowledge of economics to assess the view that very low interest rates are good for the UK economy. (AQA AS Level Economics Paper 2 June 2023)

Plan

- Intro: define interest rates, explain 'good for the UK economy'

- P1: low interest rates cause an increase in AD

- Evaluation: liquidity trap

- P2: low interest rates can cause a depreciation of the pound which can lead to an increase in exports

- Evaluation: imports become more expensive

- Conclusion: link to 4 objectives and possible conflicts

2% inflation is one of the four main macroeconomic objectives, and Extract A shows that inflation was below target at a rate of 0.6% in December 2020. Interest rates are the cost of borrowing and the reward for saving and lower interest rates can often be used to increase the rate of inflation. Whether low interest rates are good for the UK economy can be determined by their impact on the four macroeconomic objectives (2% inflation, low unemployment, economic growth and a balance of payments).

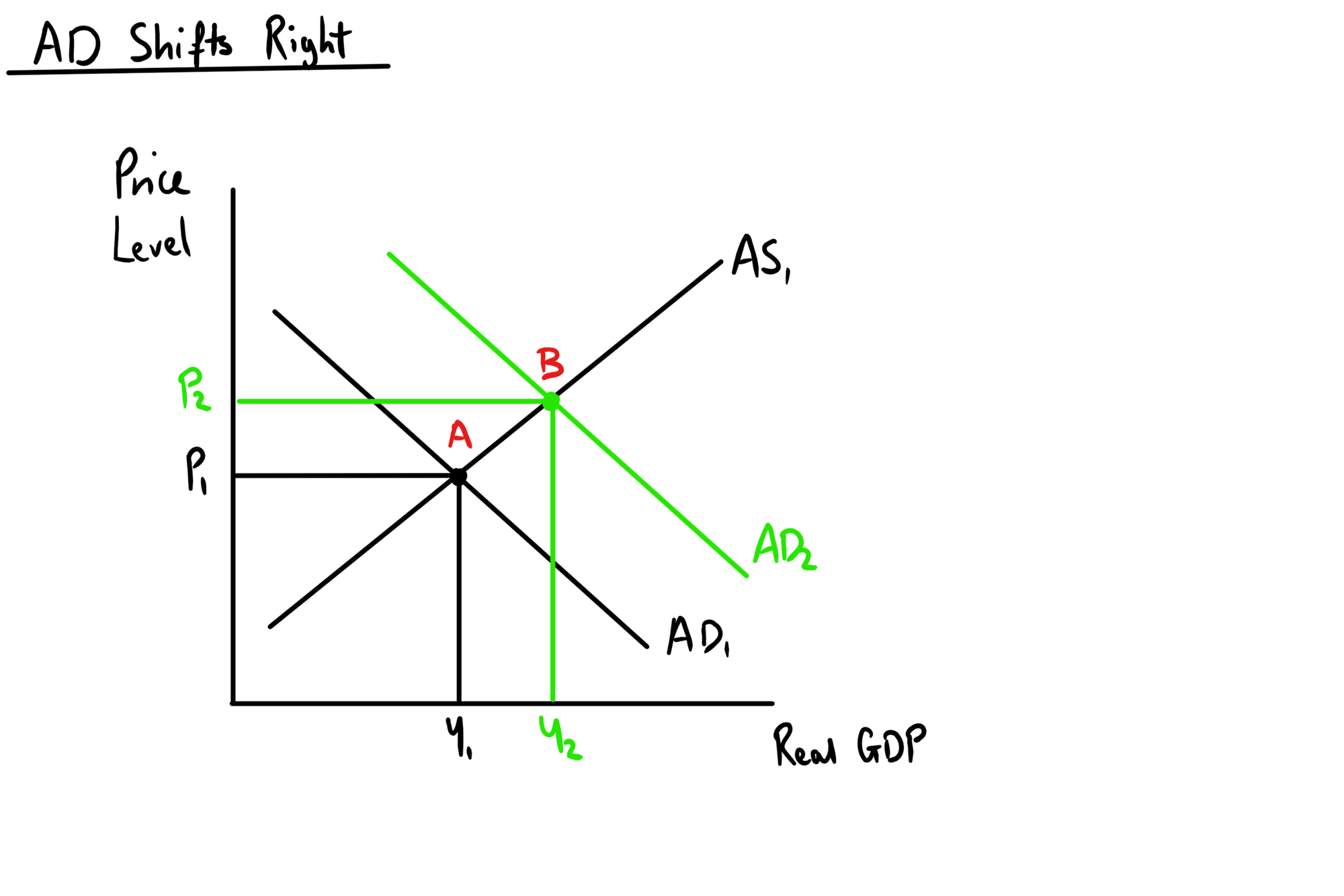

Expansionary monetary policy involves the reduction of interest rates by the Bank of England. This means there is a lower cost of borrowing and lower reward for saving. This means that consumer spending and investment is likely to increase so therefore aggregate demand will shift to the right from AD1 to AD2, since AD = C + I + G + (X-M).

The diagram shows that there is an increase in output (real GDP) from y1 to y2 - so there is economic growth. This means that there would also be a decrease in unemployment because there is greater production of goods and services which means there would be a greater demand for workers. Also, price level increases from PL1 to PL2 which means there is an increase in the rate of inflation. This iis due to the greater demand for goods and services which adds pressure on to businesses. Therefore, expansionary monetary policy can be used to achieve economic growth, lower unemployment, and a higher rate of inflation. Monetarists argue that increasing money supply is by far the most effective way to increase price level. This is because of their understanding of the Fisher equation MV = PQ. They assume that real GDP (Q) and the velocity of money (V) are always constant, which means that money supply (M) directly affects price level (P).

However, Keynesian economists argued against these assumptions - they believe that V and Q can change and have a significant impact on price level. Depending on the state of the economy, monetary policy may be ineffective. For example, if aggregate demand is very low and there are low levels of confidence in the economy, then a reduction in interest rates is still unlikely to encourage borrowing and discourage saving. People may be saving money during a recession as they are worried about losing their jobs or having a lower income - so there would be a low circulation of money and a low demand for goods and services. Therefore, people will not suddenly choose to borrow and spend money purely because of a small fall in interest rates. This is also known as a liquidity trap. This is particularly relevant during December 2020 as confidence was low during COVID. Many people feared that they may be made redundant and left without a job for a long period of time.

Another impact of the lower interest rates is that it causes a decrease in demand for the pound. This is because investors will prefer to save money in a country with the highest reward for saving, therefore choosing countries with a higher interest rate than the UK. If demand for the pound falls, the value (equilibrium price) of the pound in terms of other currencies will also fall. This weaker exchange rates makes exports cheaper and imports more expensive. If exports are cheaper, the total value of exports from the UK should increase and the value of imports into the UK should fall. Then, the balance of payments should improve, which is another macroeconomic objective. If (X-M) improves, then the value of AD will increase because AD = C+I+G+(X-M). A right shift in demand will cause further economic growth and create more jobs in the economy, but if AD increases too much (beyond full capacity), inflation may increase above target.

Also, in evaluation, the short run impact of a weaker pound can be quite damaging. If imports become more expensive, UK firms will find it more costly to pay for raw materials from abroad, and pay their energy bills. This could lead to a left shift in SRAS and also cause cost push inflation, which could make the inflation rate far too high. If wages don't increase in line with this, then people will have lower disposable incomes and a decline in living standards. However, Extract B line 14 mentions that there was already a reduction in "firms' costs of production" so a small increase should not be too damaging.

Overall, low interest rates can have different impacts depending on the state of the economy. In this case, maintaining low interest rates for a period of time should be beneficial for the UK as it would help it to meet its 4 main objectives. If inflation gets too high, the Bank of England could increase interest rates slowly or implement other policies such as supply side policies to help reduce pressure on prices.