Supply-Side Policies | A-Level Economics Model Paragraph (AQA, Edexcel, OCR)

Supply-side policies are policies that aim to increase the productive potential of the economy.

- interventionist

- increase spending on education and training

- increase spending on infrastructure

- market based

- reduce income tax

- reduce corporation tax

- reduce unemployment benefits

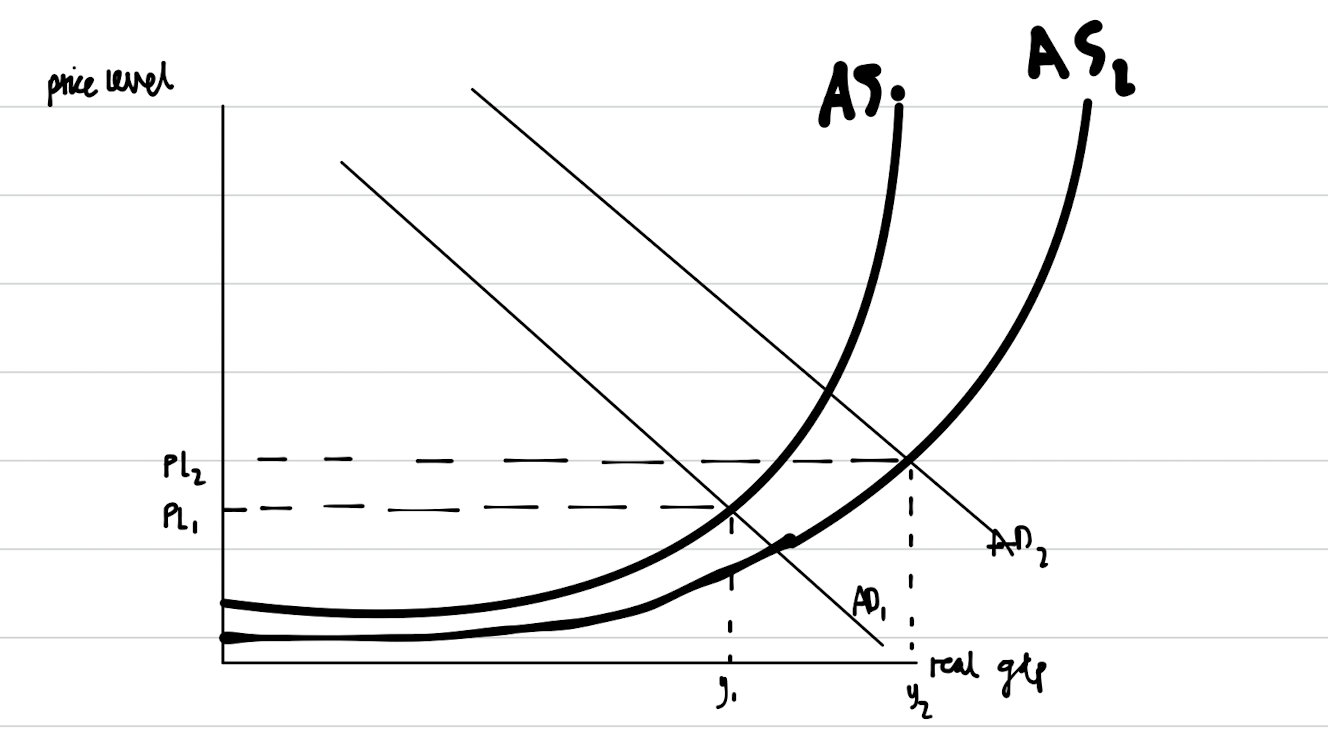

Supply side policies are the range of policies that can be used to increase the productive potential of the economy. There are both interventionist and market-based supply-side policies. One example of an interventionist policy is an increase in spending on infrastructure, for example with HS2. This increase in spending would aim to cause an improvement in transport links around the UK which would allow businesses to increase their productivity (output per worker per hour). As a result, businesses around the UK would be able to produce more goods and services with the same amount of resources. The impact of this is a right shift in long run aggregate supply, as shown below.

As a result, there would be an increase in economic growth due to the increase in real gdp (from y1 to y2), and there would also be a fall in the price level (from PL1 to PL2 as there is less pressure on existing factors of production. Supply-side policies is arguably the only way to achieve economic growth without causing inflation. There are no trade-offs between the four main macroeconomic objectives.

However, the issue with supply-side policies is often the substantial opportunity cost as well as the time lag. For example, the total budget for HS2 could reach close to £100 billion by completion. Also, the plans were proposed in 2010 but some parts of it won't be completed until around 2040. Therefore, we wouldn't see the impact on the productive potential of the economy until then. Also, since government spending is involved, aggregate demand would increase without a time lag, so you could argue that supply-side policies can cause inflation in the short term.

Other examples

- Increased spending on education and training

- greater spending to improve the quality of education and training provided

- allows workers to pick up more useful skills

- workers will become more productive on average

- measured as higher output per worker per hour

- firms in the economy can produce more with the same factors of production

- therefore the productive potential of the economy increases

- time lag (degrees take 3+ years)

- opportunity cost (gov may raise taxes in the future which can decrease sras or lras)

- higher skilled workers may demand higher pay (causing lras to shift left)

- Reduction in income taxes

- For example, if the government to cut income taxes

- that would cause more people to be willing and able to work

- for example, skilled workers may move back into the UK, or come out of retirement - as they would be taxed less when earning their salary.

- As a result, firms have more skilled workers to choose from

- this would boost productivity and therefore boost the productive potential of the economy

- as firms can produce more output without any extra strain on their resources. This can be shown by a right shift in the LRAS curve.