Savings Gap | A-Level Economics Model Paragraph (AQA, Edexcel, OCR)

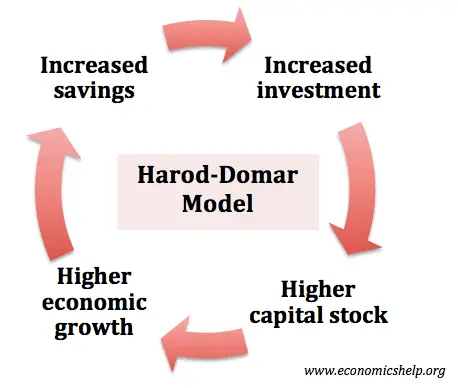

The Harrod-Domar model explains why high savings can be a key factor in allowing an economy to achieve economic growth and therefore also achieve economic development, which is commonly measured by the Human Development Index, which tracks improvements in life expectancy at birth, adult literacy rates, and real GDP per capita.

Increasing levels of income will lead to the average consumer having a higher marginal propensity to save, which will lead to increased savings. As a result, banks will have higher liquidity. This will lead to banks being more willing and able to lend money at lower interest rates, which should lead to firms being more willing and able to borrow. There is an assumption in the model that this will lead to increased investment (

- the Harrod-Domar model suggests that low national savings and poor capital output are the biggest barriers preventing the development of an economy

- it explains that

- higher level of savings

- makes investment in capital easier

- a better capital stock leads to higher economic growth

- this allows for further savings and further investment in capital stock

- it explains that low national savings leads to poor investment in capital

- this is difficult for developing countries to achieve because there is no easy way to increase savings in the economy

- it is also possible to enter this cycle if the government directly subsidise or invest in capital

- A* point

- rate of economic growth = level of savings/ capital output ratio

- e.g. if savings rate is 10% and capital output is 2x

- then the economy will grow by 20%