Revenue Maximisation | A-Level Economics Model Paragraph (AQA, Edexcel, OCR)

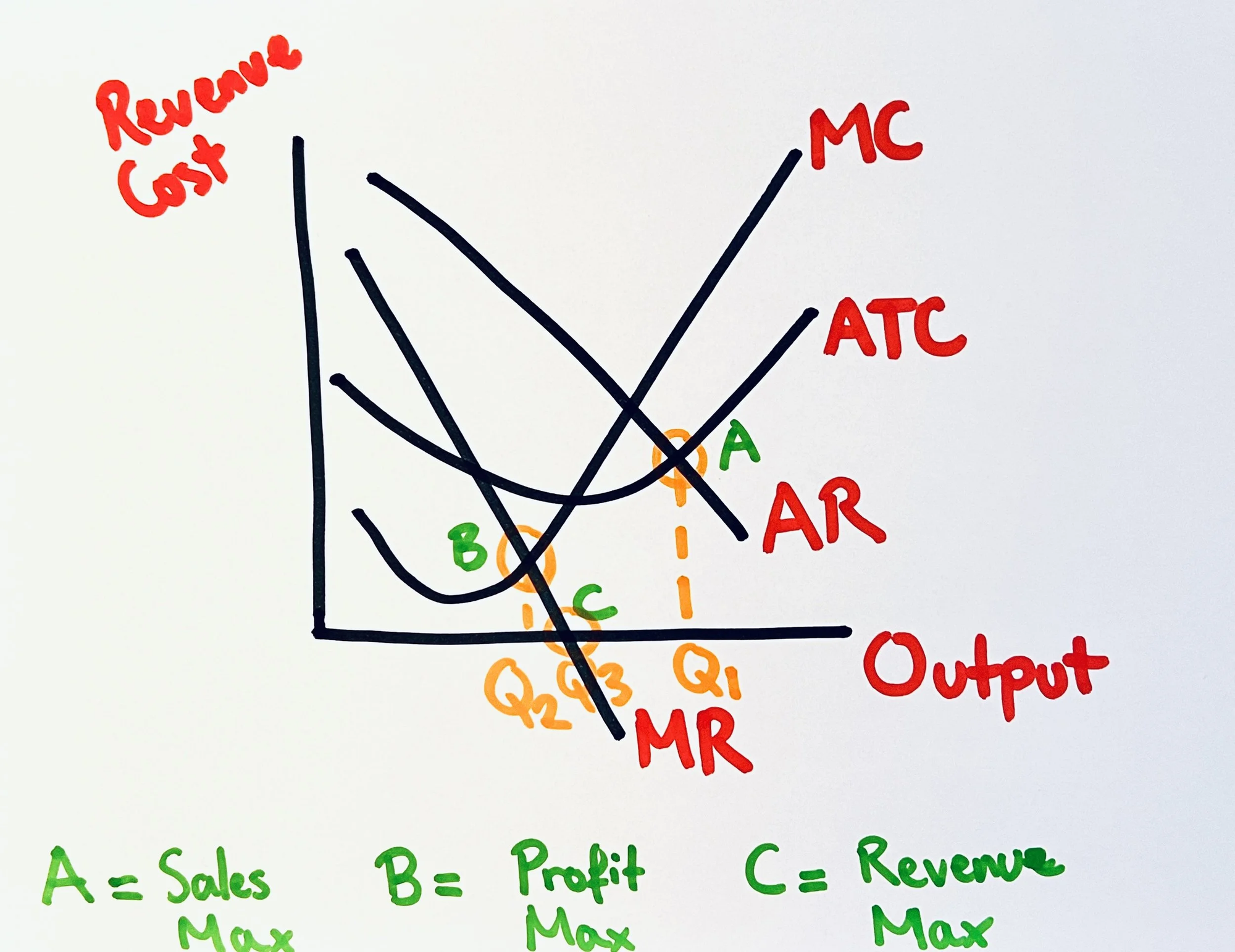

Revenue maximisation occurs when firms aim to achieve the highest possible total revenue, which is equal to the price x quantity sold. Revenue maximisation is derived at the quantity where marginal revenue equals 0. Marginal revenue (MR) is the additional revenue gained from selling one more unit of output. It is a downward sloping curve, twice as steep as the average revenue curve. MR = 0 will lead to maximum total revenue because past this point, any additional unit sold would actually reduce total revenue as the firm would need to lower prices significantly to sell more output. This is because firms face downward-sloping demand curves in imperfect competition, meaning they must reduce prices on all units to increase sales volume.

Revenue maximisation can be important for businesses in several scenarios. New firms entering competitive markets may prioritise revenue maximisation to rapidly gain market share and establish brand recognition, even if they make less profits in the short-term. Firms who gain market share are able to further exploit and benefit from economies of scale. This is when long-run average costs fall as output increases. For example, they would be able to achieve purchasing economies of scale by bulk buying. Also, firms operating in industries with high fixed costs, such as airlines, cinemas, or streaming services like Netflix, may focus on maximising revenue to spread these fixed costs across as many customers as possible. Firms can always choose to switch back to the more sustainable profit maximisation strategy later down the line. In market structures like oligopolies, revenue maximisation is even more useful as there are high barriers to entry. Once a firm is able to dominate a market, it is difficult for new firms to enter, so the firm gains more price making power, making profit maximisation more convenient.

However, revenue maximisation is not ideal as a long-term business objective. Firms could operate at substantial losses while maximising revenue which would lead to a business to have to shutdown if this happens over a long enough time. Revenue maximisation also conflicts with shareholder interests, as investors typically expect returns through dividends funded by profits, not just high sales volumes. However, it can occur frequently due to the chance that manager bonuses are tied to sales or revenue targets, Overall, while revenue maximisation can serve specific strategic purposes in certain circumstances, it is more useful as a short-term tactic rather than a long-term business objective.

Looking for friendly and high quality help with A-Level Economics? I offer online and in-person tutoring across the UK, covering all exam boards (AQA, Edexcel, OCR). With over 8 years’ experience and deep knowledge of each specification, I help students master key concepts like revenue maximisation, exam technique, and essay structure.