Progressive Tax and Benefits | A-Level Economics Model Paragraph (AQA, Edexcel, OCR)

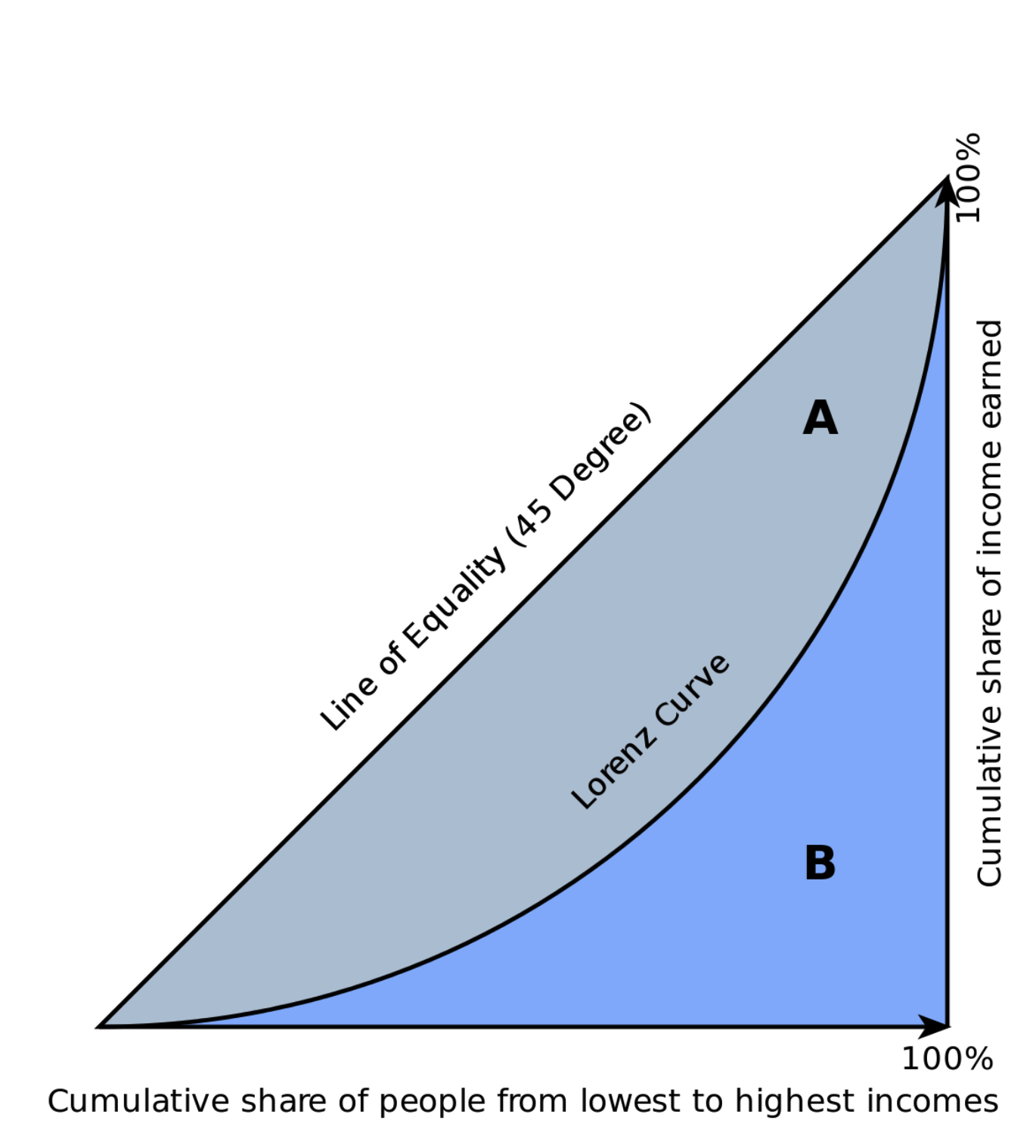

One way of measuring inequality is the Gini coefficient, which compares the area between the Lorenz curve and the line of perfect equality to the whole triangle beneath that line:

G = A / (A + B).

In the UK in 2022/23, the top 20% of earners received 36% of total disposable household income, illustrating a significant degree of income inequality. A key method the UK uses to reduce this inequality is its progressive tax and benefits system. Progressive taxes mean that as income rises, a higher proportion of income is taxed. This revenue is then redistributed via means-tested benefits and free public services (such as education and healthcare), reducing inequality in net incomes and access to key services.

The UK has a Gini coefficient of 0.35, which is relatively low by global standards. For example, Norway’s is just 0.28, suggesting more equal income distribution.

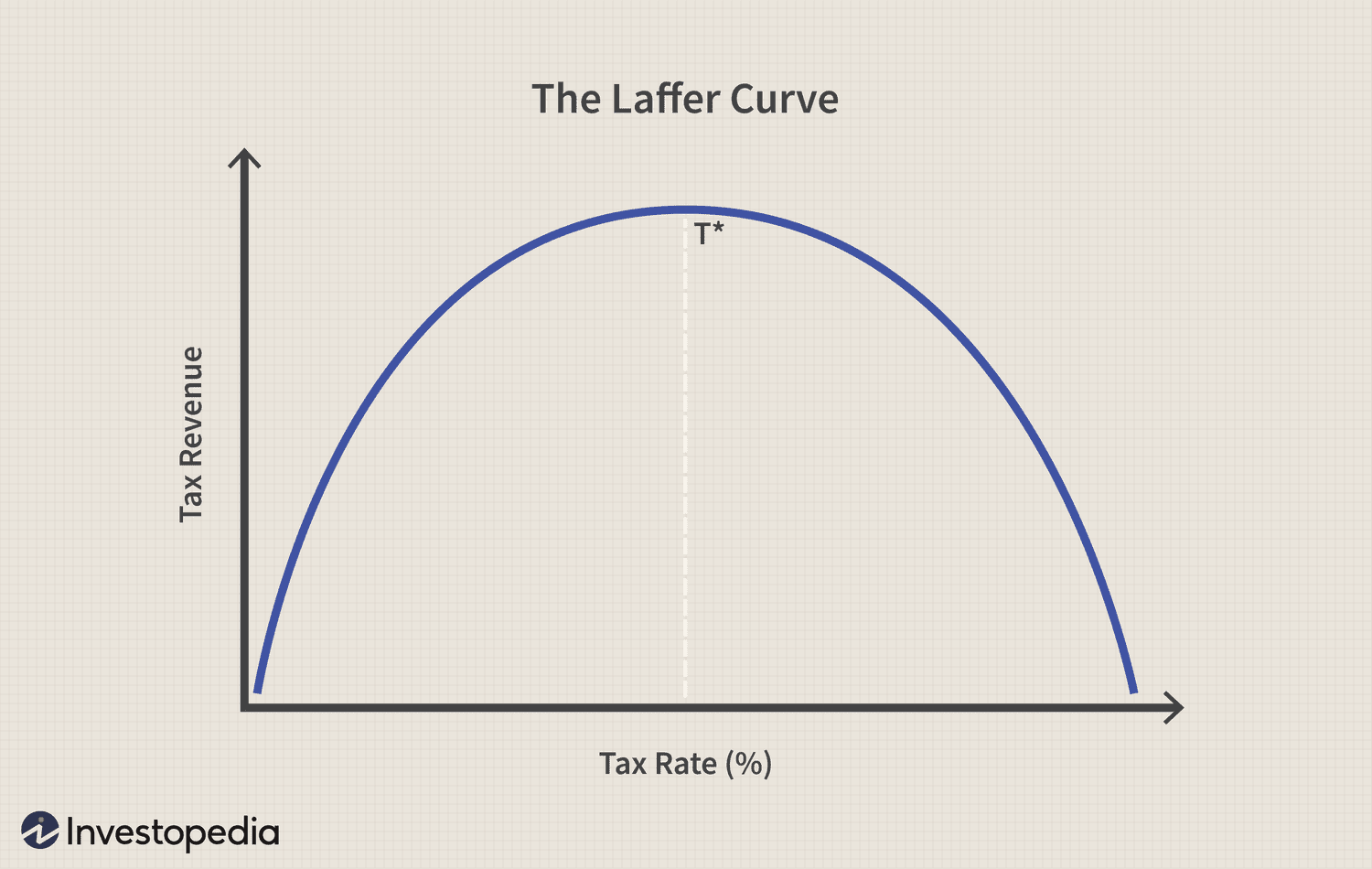

However, the Laffer Curve highlights a limitation of progressive taxation. While increasing income tax rates initially raises revenue, beyond a certain point it may disincentivise work and lead to lower total revenue.

For example, high-skilled workers may retire early, reduce their labour supply, or relocate to low-tax jurisdictions like Dubai. At the same time, generous benefits may reduce work incentives for the unemployed, weakening the incentive structure of competitive labour markets. Over time, this may result in lower labour force participation, reduced productivity, and falling business profits, leading to lower corporation tax receipts. The government may then have less funding for public services, potentially lowering the quality of education and healthcare. This could deepen inequality over time by increasing the risk of individuals falling into a poverty trap.

About Me

These A-Level Economics Notes have all been written personally. I studied Economics at UCL after studying A-Level Maths, Economics & Chemistry in 2017. I have been tutoring A-Level Economics since 2017 and wanted to create these model paragraphs and chains of reasonings to provide a foundation for writing detailed paragraphs in A-Level Economics essays. They are an excellent complement to the video tutorials available on my Youtube channel and my summary notes. For any additional questions, or for A-Level Economics tutoring, I welcome enquiries via this Form, Phone, or Whatsapp.