Profit Maximisation | A-Level Economics Model Paragraph (AQA, Edexcel, OCR)

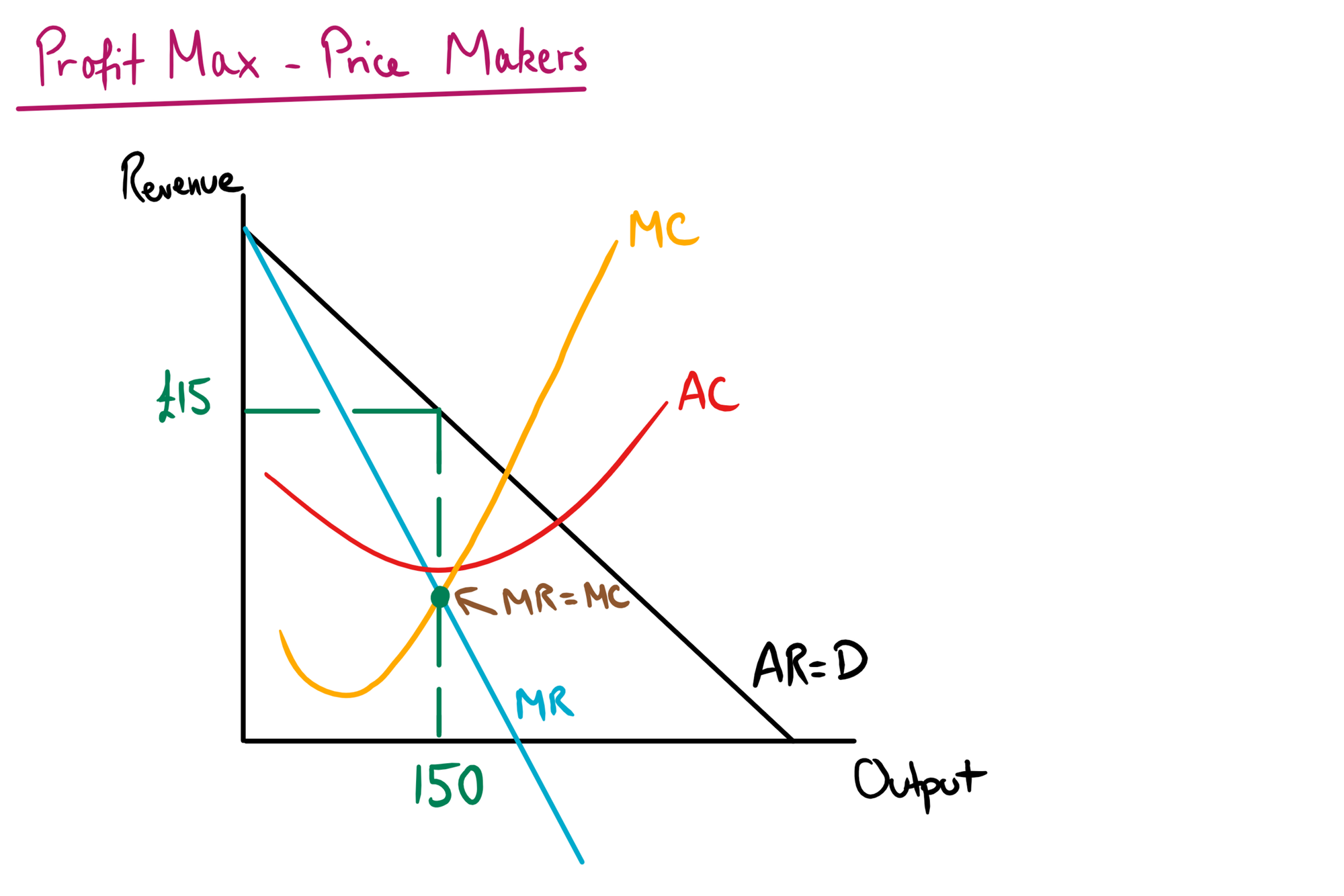

Profit is the entrepreneur's reward for taking risks when running a business. It is calculated as total revenue minus total costs, and profit maximisation occurs at the quantity where MC = MR. Marginal cost (MC) is the additional cost from producing one extra unit of output. Initially, MC typically falls due to efficiencies gained from increased production, but eventually rises due to the law of diminishing returns; as more workers are added to fixed capital, each additional worker contributes less to total output, making each extra unit more expensive to produce. Marginal revenue (MR) is the additional revenue generated from selling one extra unit. In perfect competition, MR equals price as firms are price-takers, but in imperfect competition, MR falls is downward sloping (roughly twice as steep as AR) because firms must reduce prices on all units to sell additional output.

Profit is maximised where MC = MR because at this point, the cost of producing one extra unit exactly equals the revenue it generates. If MR > MC, the firm should increase production as each additional unit adds more to revenue than costs, increasing total profit. Conversely, if MC > MR, the firm should reduce output as each additional unit costs more than it generates in revenue, reducing total profit.

Therefore, profit maximisation occurs at the precise point where these marginal values are equal, ensuring the entrepreneur receives the optimal reward for their risk-taking. The diagram below shows this.

Profit maximisation is assumed to be the main business objective. Traditional economic theory assumes that all economic agents are rational utility maximisers, and since business owners derive utility from profit, it is natural for them to pursue profit maximisation as their primary objective. Profit can have two main uses: firstly, they satisfy shareholders who have invested capital and expect returns on their investment, and secondly, profits can be reinvested into the firm for innovation, and research and development, which allows for them to achieve dynamic efficiency. This then allows customers to have access to higher quality goods and services, which increases their welfare.

However, profit maximisation is not always appropriate for firms. Some firms may choose to revenue maximise instead to increase market share and establish market dominance, even if this reduces short-term profitability. Additionally, in large corporations there is often a divorce of ownership from control, where shareholders own the business but managers are in control day-to-day. This creates a principal-agent problem where managers (agents) may pursue objectives that differ from shareholders' (principals) profit maximisation goals. Managers might focus on sales maximisation to enhance their reputation and job security, or prioritise work satisfaction and personal benefits, leading to satisficing behaviour where they aim for satisfactory rather than optimal profit levels. Overall, while profit maximisation remains the most important business objective overall, it can be difficult to achieve at times.