Market Structures | A-Level Economics

Characteristics used to define each market structure

- number of firms

- product differentiation

- barriers to entry

- price takers or price setters

- perfect information or imperfect information

What efficiencies do you judge a market structure on?

- produtive efficiency

- allocative efficiency

- dynamic efficiency

Efficiency

What is productive efficiency?

- Firms achieve productive efficiency when they produce at the quantity where MC = AC

- This means that they are minimising costs and producing the maximum possible output with the resources available

- This means there is no waste, and they are contributing the maximum they can to the economy.

What is allocative efficiency?

- Firms achieve allocative efficiency when they produce at the quantity where MC = AR

- This means that consmer surplus is maximised.

- It would be impossible to make anyone better off without making another person worse off

What is dynamic efficiency?

- Firms can achieve dynamic efficiency when they make supernormal profits in the long run.

- This allows them to re-invest and improve the quality of their products

- If consumers can gain access to higher quality goods and services at similar prices, their consumer surplus would increase.

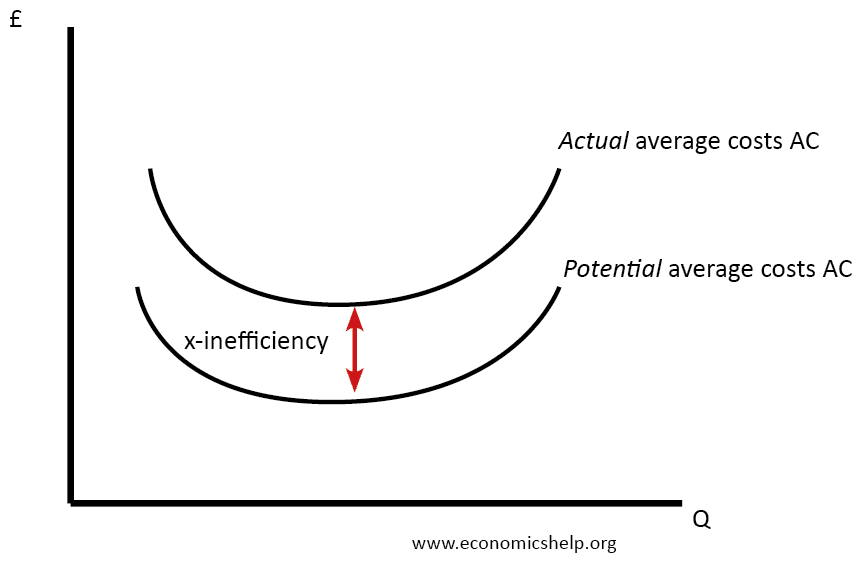

What is X-inefficiency?

- X-inefficiency occurs when a firm has no incentives to control their average costs.

- This can happen due to monopoly power or divorce of ownership from control. A monopoly knows they can make supernormal profit from charging higher prices instead of controlling costs.

Perfect Competition

What are the characteristics of a perfectly competitive market?

- Many buyers and sellers

- No barriers to entry or exit

- Firms are price takers

- Firms sell identical products

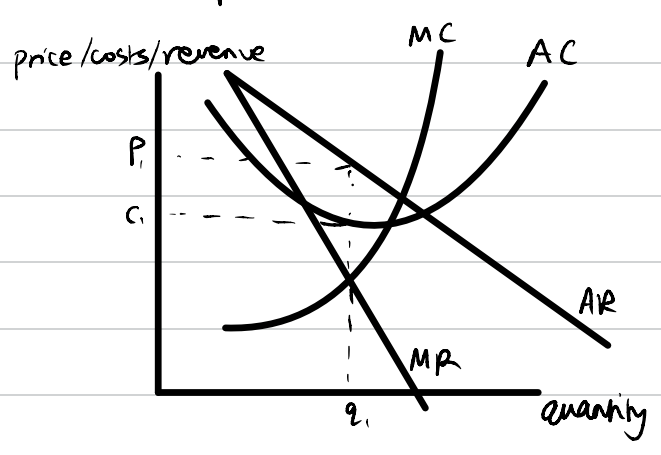

Perfect competition short-run diagram

AR (the demand curve) is perfectly elastic because firms are price takers and there are many sellers with identical subsitutes. Firms cannot raise or reduce price because they would lose demand, or other firms would copy them.

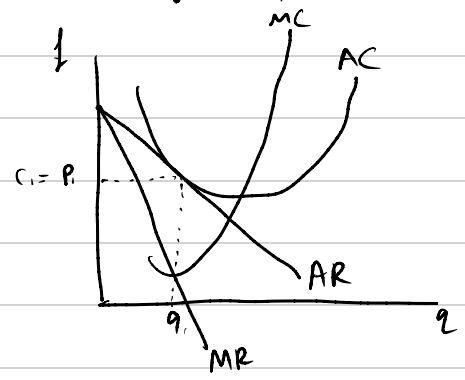

What happens between the short-run and the long-run?

As firms are making supernormal profits in the short-run, oher firms notice that there are no barriers to entry so they join the market. This causes market supply to increase. Each firm has lower demand so AR shifts to the left and firms return to normal profits only.

Perfect competition long-run diagram

3.4.3 Monopolistic Competition

What are the characteristics of a monopolistically competitive market?

- Low barriers to entry

- Slight product differentiation

- Firms are vulnerable to hit and run competition

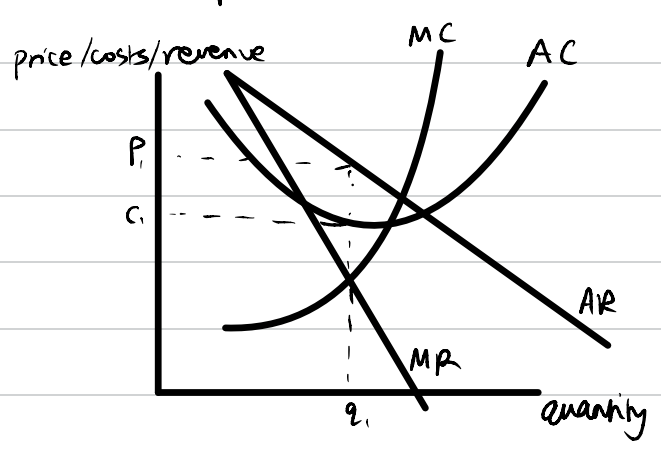

Monopolistic competition short-run diagram

In the short-run, firms maximise profits at the point where MC=MR.

What happens between the short-run and the long-run?

As firms are making supernormal profits in the short-run, other firms notice that there are low barriers to entry so they join the market. This causes market supply to increase. Each firm has lower demand so AR shifts to the left and firms return to normal profits only.

Monopolistic competition long-run diagram

Oligopoly

What are the characteristics of an oligopoly?

An oligopoly is a market which is dominated by a few firms. Oligopolies can vary from being competitive to non-competitive or even collusive.

In a non-competitive oligopoly, one or two firms can have monopoly power (more than 25% market share) and they are also more likely to attempt to collude.

- high barriers to entry and exit

- firms are interdependent

- product differentiation

Oligopolies can be defined better by their market conduct, not just their characteristics.

How to calculate an n-firm concentration ratio?

Add the market share of the top n firms.

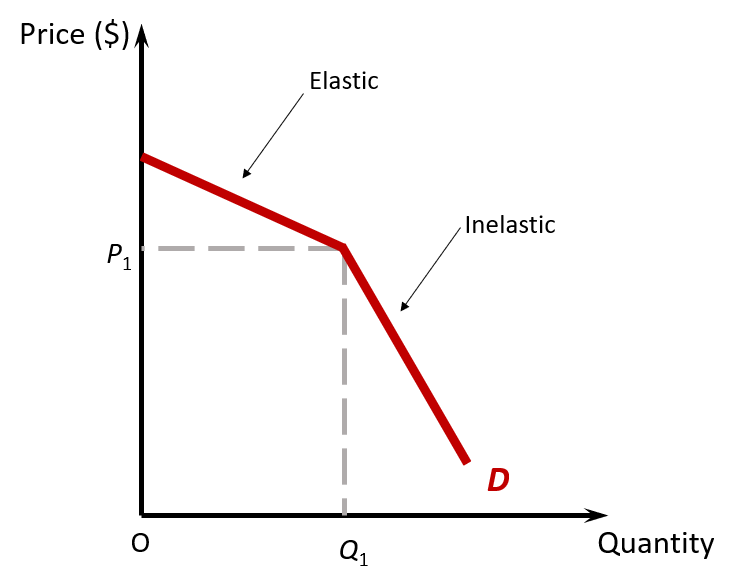

The Kinked Demand Curve

The Kinked Demand curve is one way of modelling firms in an oligopoly.

It shows why prices are most likely to be stable (and not too high) in a typical oligopoly.

If a firm raises their prices past p1, quantity demanded falls by a lot as customers will buy goods and services from competitors instead.

If a firm reduces their prices, quantity demanded only increases by a small proportion because other firms would immediately lower their prices as well, so the firm wouldn't gain many customers.

Therefore, firms are scared to change prices.

Impact of stable prices

Because firms know that they can't gain much market share by reducing prices, firms instead focus on non-price competition.

This means that firms try to improve on things like branding, customer service loyalty discounts e.g. supermarkets like Tesco offer Clubcards.

Evaluation - Kinked Demand Curve model

Long term, it does not make sense to deviate from p1, but there are some cases where firms will change prices.

- a market leader may feel more confident than other firms in raising prices, as they may have more customers that are loyal to their brand.

- some firms/stores may have other objectives e.g. sales maximisation so they may reduce their prices to gain or maintain a high market share at different times e.g. Boxing Day sales. This can lead to price wars, but the key is that they are not sustainable and will not last.

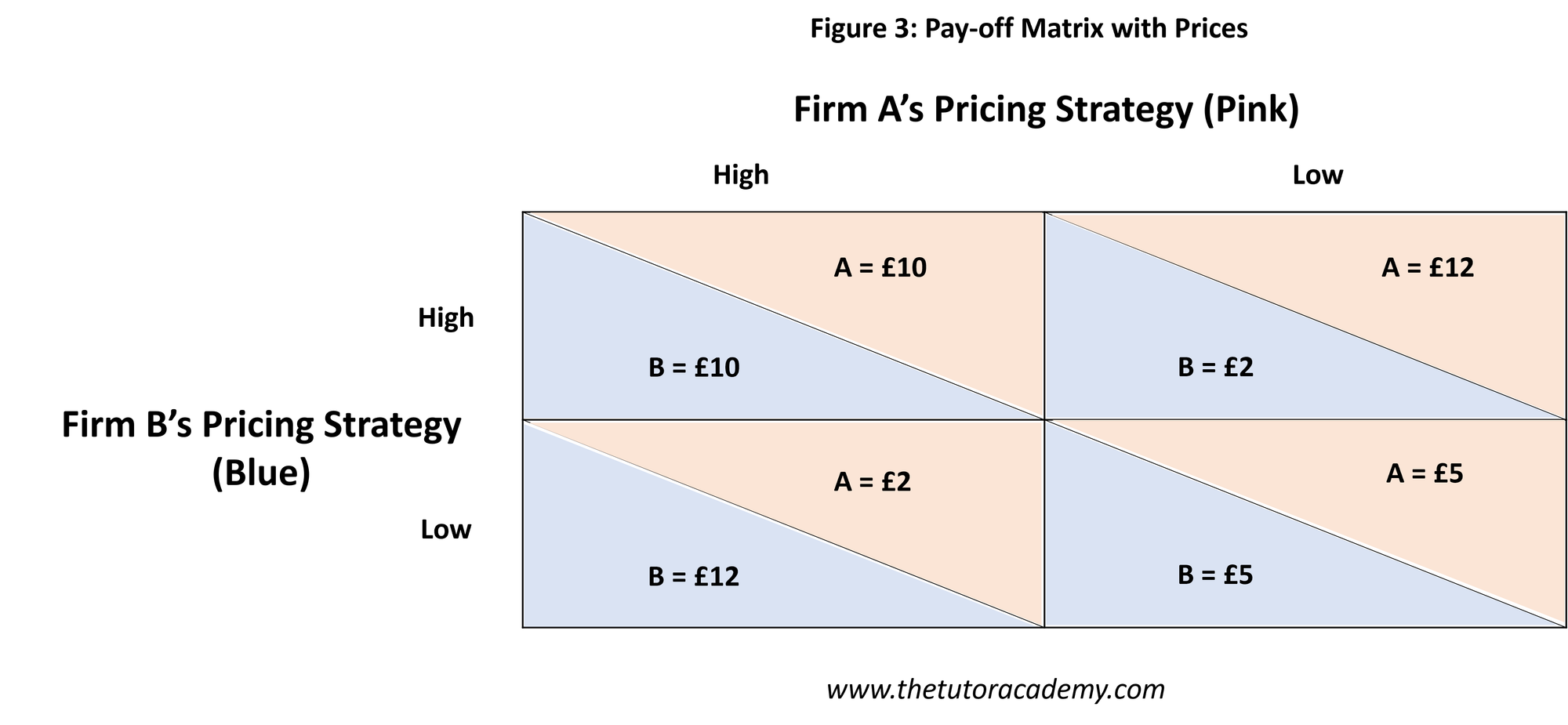

Prisoner's dilemma and the two-firm two-outcome model

This model is generic (unrelated to market structures) but demonstrates how two people think when their outcomes are interdependent, based on each other's choices.

This model relates to firms having to make a decision on pricing.

If firms cannot communicate - firms are going to be scared of being undercut. For example, if firm A sets a high price, there is a big chance that firm B undercuts them leaving firm A with only £2 profit. Firm B will be worried of the same thing. This is why the Nash equilibrium is (low, low). The Kinked Demand curve illustrates the same concept.

If firms CAN communicate - firms would agree to BOTH set high prices. This means that they can get a return of £10 each. This is only possible if there is significant trust between the two firms, which is only possible through collusion. The difficulty is that the CMA monitor markets to ensure that firms are acting in the best interest of consumers, so they are not likely to allow this. Firms may get away with it in the form of tacit (informal) collusion.

What is collusion?

Collusion is when two firms both agree to set higher prices

What is overt collusion?

Overt collusion is formal.

What is tacit collusion?

Tacit collusion is informal.

Monopoly

Characteristics of a monopoly

- one firm dominates the market

- high barriers to entry

- price-making power

What is a pure monopoly?

Sole seller in the market (one firm has 100% market share)

What is monopoly power?

One firm has more than 25% market share

What are some examples of barriers to entry?

- economies of scale

- economies of scale

- marketing budget

- technology

- patents

- high start up costs

- legal barriers

What do monopolies aim to do?

- maximise profit

- to pay dividends to shareholders

How do monopolies achieve profit maximisation?

- by producing at MC = MR?

What are the benefits of monopolies for consumers?

Dynamic efficiency

- Monopolies are dynamically efficient

- This means that monopolies e.g. Apple re-invest their profits and improve their products

- This is only possible by firms who make supernormal profits in the long-run.

What are the costs of monopoly for consumers?

Allocatively inefficient

- Monopolies are NOT ALLOCATIVELY EFFICIENT

- This is because monopolies over-charge their customers.

- Price is far greater than marginal cost.

What are the benefits of monopolies for firms?

Economies of scale

- Economies of scale are when a firm increases their output, their long-run average cost falls

- For example, firms like Apple can save costs by bulk buying

- This allows them to increase their market share

What are the disadvantages of monopolies for firms?

Productively inefficient

- Productive efficiency is when a firm is at the lowest point of the short-run average cost curve

- Instead, the firm does not minimise cost as they can make supernormal profit by charging prices.

- Therefore there is some wasted resources.